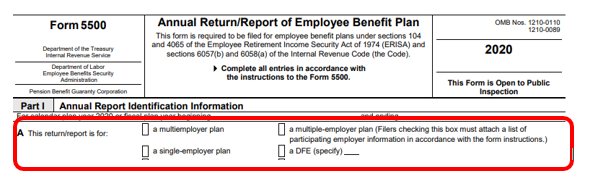

Start your engines! February is Wrangle’s “Dashboard Data Entry Month,” as it is the best time to consider the 2020 calendar year Form 5500s before you are crazed with strategic planning meetings and renewals.

One dangerous practice is to assume, “If it was fine last year, this year I will just carry forward.” Always review and consider with fresh eyes to ensure all information is accurate. One area that trips up many is the employer status information.

Have you considered the following?

- Is there a union involved in bargaining the details for the policies and benefits?

- The group has multiple EINs. Does that mean I check the box for multiple employers?

- The group’s plan is under a trust. Does that mean I check the box for the DFE?

- ABC Company acquired XYZ. I think that they combined all the benefits. Should I check the box for a single-employer?

Below are the definitions of the Employer Status to review, as well as the correct box to check for the list above:

DEFINITIONS:

- Single-Employer Plan

A single-employer plan is a plan sponsored by a single corporation, partnership, or sole proprietorship that covers only employees of that single employer. A plan covering employees of one employer in a controlled group, or group of employers under common control, is still a single-employer plan for which a single annual filing is made.- Please note: Common Control for 5500s follows the IRS Code 414(c) at 80% or more ownership of a corporation owning of a subsidiary. If the ownership structure is of a brother-sister group (individuals owning multiple companies), the percentage is different. Click here for more information.

- DFE

A DFE is a Direct Filing Entity. Banks, investment companies, and other financial institutions that manage plans often group various plans that may or may not be related. Once they are pooled, the managing institution can report information about them in unison by filing as a DFE. A Direct Filing Entity can be but is not limited to:- Common/Collective Trusts

- Direct Filing Entity: 13-12 Investment Entity

- Group Insurance Arrangement

- Master Trust Investment Account (5500 is required)

- Pooled Separate Account

- Multiemployer

A plan maintained pursuant to one or more collective bargaining agreements (has a Union in place), under which more than one employer contributes to the plan on behalf of its employees. In addition, a Multiemployer plan is a plan:- To which more than one employer is required to contribute

- Maintained pursuant to one or more collective bargaining agreements and that has made no election under code section 414(f)(5) not to be treated as a multi-employer plan

- Multiple-Employer

A plan that is maintained by two or more unrelated employers and fits the descriptions shown below:- There is more than one employer contributing to the plan

- The contributions of each employer are pooled and made available to pay benefits to all participants

- Plan may be a collectively bargained plan and may be either a pension benefit or welfare benefit plan.

ANSWERS:

Please note the information details below are brief. If you need more information, please reach out to Ann McAdam at Wrangle: amcadam@wrangle5500.com.

1. Is there a union involved in bargaining the details for the policies and benefits?

Multiemployer should only be checked if Unions are involved in the benefits negotiation process.

Please see number two below for more information on multiple-employers.

2. The group has multiple EINs. Does that mean I check the box for multiple-employers?

Many parent-subsidiary groups have multiple EINs to handle the business side, taxes, payroll etc. However, in the benefits world, one EIN may be selected to represent the Plan Administrator of the benefit plan and is listed in the Wrap Plan Document.

As a result, multiple-employers can still have single-employer checked if they share the benefits and the groups are all related and are common control.

Best practice if multiple-employers are sharing benefits is to have an ERISA attorney review to make sure the group meets the criteria to be a single-employer or a multiple-employer welfare arrangement – a MEWA (employers are unrelated and do not have common control but share the benefits).

3. The group’s plan is under a trust. Does that mean I check the box for the Direct Filing Entity (DFE)?

Having a trust does not automatically result in the 5500 being under a DFE. A trust can be just how the funds are handled which would be noted on page two of the 5500 under 9a and 9b. To have a DFE, a fund manager will have investments from more than one Plan Sponsor.

4. ABC Company acquired XYZ. I think that they combined all the benefits. Should I check the box for a Single employer?

Acquisitions are a slippery slope. If benefits are shared, however, if a group is not wholly-owned and common control is not established, a multiple-employer welfare arrangement may have formed. Always look to the ERISA Plan Documents for confirmation of who the plan sponsor is, the arrangement of the benefits, and what benefits are under which ERISA Plan. Best practice is for an ERISA attorney to review and advise. To help be more acquainted with acquisitions, Wrangle wrote a blog on Acquisitions last year. Find it here.