Wrangle provides clients with well-established, audit-tested plan documents intended to meet the requirements of various federal laws and regulations, most notably, ERISA. We have delivered over 6,700 projects to satisfied clients since 2017.

All Services Are Prepared by a Team of Dedicated People Who Have Intricate Knowledge on Plan Documents, NDT and ERISA Annual Notices

To ensure compliance with current regulations of the Plan Documents as well as other ERISA projects, we are supported by ERISA Attorneys from our parent company Ascensus. They conduct annual and as-needed reviews of the Plan Documents.

There are no Annual or Recurring Fees Associated with these services.

- One-on-one support is available for each project;

- Language can be added specific to each client, such as the addition of wellness

program provisions, Section 1557 Notice, mid-year election changes and more - There are no recurring annual fees (we follow ERISA rules on timing of changes)

- Services available include much more than wraparound documents. We can prepare documents for Cafeteria plans and self-insured reimbursement plans. We also can prepare annual notices packets.

Contact Us Today for Pricing

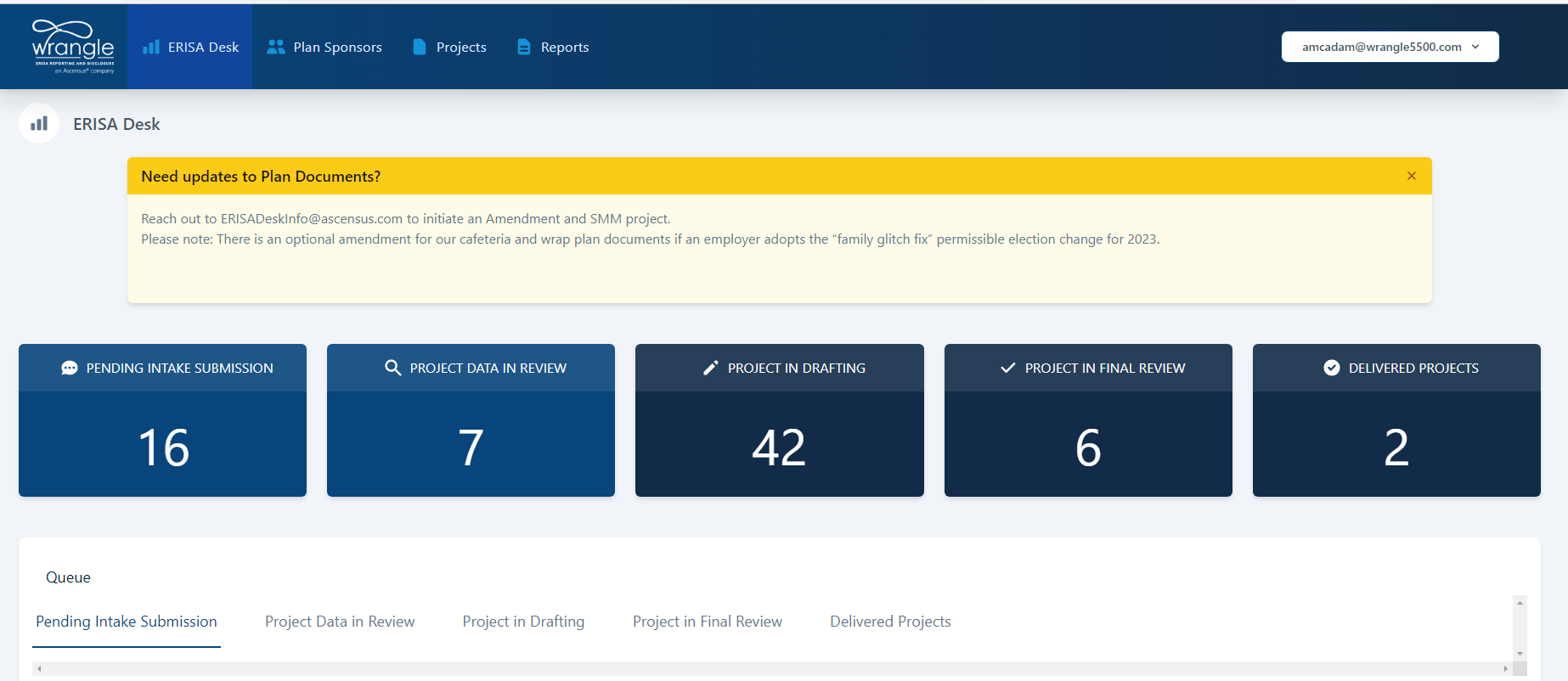

Wrangle’s Online Platform Is Used to Initiate Preparation of Client’s Plan Documents, SPDs and Nondiscrimination Testing

To initiate login to the Platform. The same login used for the 5500 Dashboard will work. If you don’t have the login, please contact ERISADeskInfo@ascensus.com

- After you submit the data, Wrangle’s ERISA Desk team will move forward to review the data, ask questions and prepare the documents.

- Before drafts are issued, an experienced ERISA Desk team member will review the drafts.

- Once finalized, the ERISA Desk Team will send out a delivery status email to alert that the documents are ready to be downloaded using the link to the Platform. In addition, support documents, such as the SPD Distribution guide, will be included.

- The Broker/Client should plan to review within the first three months of receipt of the documents.

After the documents have been approved by the Plan Sponsor, they need to be signed to ensure that they are official or considered fully executed.

Templated ERISA-level annual changes resulting in amendments for the Plan Documents and SMM for the SPDs, will be issued at no cost. If there is a Plan-level change the ERISA Desk team will charge a small nominal fee to prepare customized amendments and SMM.

To learn more, click on our blog entry covering our new Platform.

About Wrangle’s Documents:

In 2022, we decided to make the switch to our parent company’s set of Plan Documents as they are constantly maintained by an incredible team of internal ERISA attorney staff members. By adopting this new practice, we can expand our ability to assist through complex ERISA situations. ERISA attorney staff members will be available as a resource to review customized language requests or other ERISA document compliance questions.

We also provide an additional document – the Adoption Agreement. This document may be new to you as it is more commonly found with pension plans. It takes the details of a Plan Document and lists them in an easy to read format. In many ways, it appears as an information guide to help you focus on specific details without the surrounding legalese language.

What is the Summary Plan Description (SPD):

Answer: The SPD is probably the most important document required by ERISA. The SPD is the main vehicle for communicating plan benefits, rights and obligations to participants and beneficiaries, and it will often be enforced over the plan document, which is typically not disclosed to covered individuals. Since most booklets and EOCs fail to contain all the information required by ERISA, it is important to distribute the SPD to plan participants to bring the booklets into compliance with ERISA’s SPD requirements. The booklet/EOC provided by each insurer or health plan service organization will provide a full description of the plan of benefits, their limitations, and the policyholder’s eligibility rules.

Who is to Receive the SPD Document:

- Covered employees (but generally not spouses or dependents).

- Other possible recipients include:

- COBRA-qualified beneficiaries;

- Custodial/parent guardians of minor children under a QMCSO;

- Covered retirees or their covered surviving spouses/dependents.

When to Furnish SPD Documents:

- Within 90 days of initial coverage (i.e. new hires);

- Within 120 days after the plan is first established;

- Every 5 years an updated SPD must be prepared and distributed, replacing the prior version;

- Upon request.

Summary of Material Modification (SMM):

Plan Administrators can modify SPDs that are less than five years old by preparing and distributing a Summary of Material Modification (SMM) to plan participants either 210 days after the end of the plan year in which the change is adopted or 60 days (if there is a significant reduction in benefits).