Wrangle met in person with the DOL in June at their EFAST2 Nashville conference to discuss the 2023 Form 5500 that will be released on January 1st. We also inquired on how the DOL would like to handle level funding and stop loss reporting in the Form 5500, as these benefits have brought many questions to us. (Please see our previous blogs on level funding and stop loss). We have the details of these discussions for you below to keep you as informed as we are.

Wrangle met in person with the DOL in June at their EFAST2 Nashville conference to discuss the 2023 Form 5500 that will be released on January 1st. We also inquired on how the DOL would like to handle level funding and stop loss reporting in the Form 5500, as these benefits have brought many questions to us. (Please see our previous blogs on level funding and stop loss). We have the details of these discussions for you below to keep you as informed as we are.

Specific 2023 Health and Welfare Form 5500 Changes

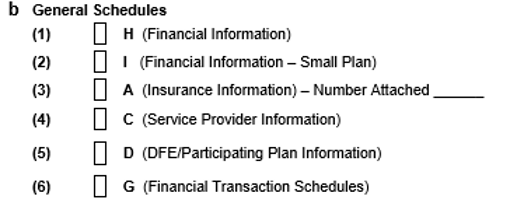

- There will be a new placement for the line that indicates the number of Schedule As included in the Form 5500. Currently, the line is to the left of the Schedule A. In the 2023 Form 5500, the line will be to the right of the A (insurance information).

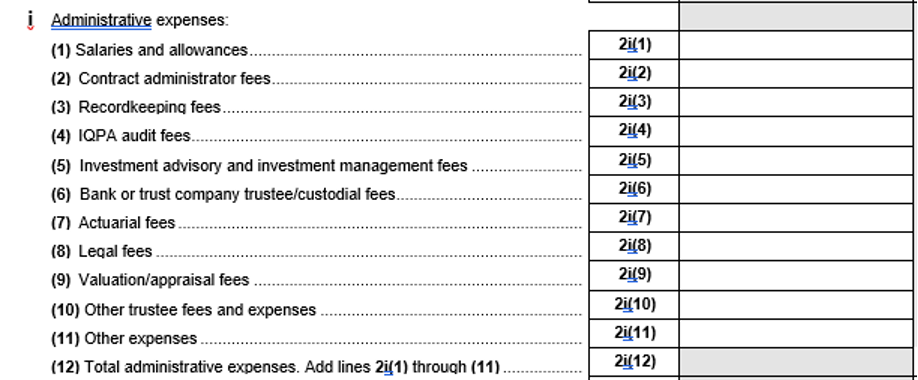

- Additional administrative expenses lines will be added to the Schedule H. In 2022 and prior there were just five lines. It jumps up to 12 lines of data.

DOL Process Changes

- Currently, the Form does not allow EINs that start with 96 and 97. With the 2023 Form Year, these numbers will be allowed. (The only ones that will not be allowed are EINs starting with 69, 70, or 79.)

- Starting on 1/1/2024, only Form years 2021, 2022, and 2023 will be active and be allowed to e-file.

Level Funding and Stop Loss

For 5500s, level-funding is typically reported in the same manner as a self-insured benefit. However, this benefit sets the stage to hold employee contributions or assets for longer than 90 days which then requires a trust filing. Currently, the Form 5500 Instructions provide no direction on this type of funding.

As for stop loss, a Schedule A is required if there is a trust. Without a trust in place, the stop loss typically would not be reported on a Schedule A as this is deemed an employer benefit, not an employee benefit (5500s report employee benefits). However, many employers receive employee contributions that cover the stop loss premium which muddies the determination to include on a Schedule A or not. Technically speaking, employee contributions/plan assets for stop loss would require a Schedule A to be included. Again, the instructions don’t elaborate to give proper direction.

Lynda, our Vice President, spoke with the DOL’s Senior Employee Benefits Law Specialist, EBSA/DOL, and asked her if the DOL has considered providing further definition or guidance on how to report stop loss and level funded arrangements. The DOL representative acknowledged that they are receiving this question, yet have no definitive response. Her first recommendation would be for the Plan Sponsor to check their Wrap Plan Document and SPD for direction. She further acknowledged that this is an actively changing area as providers are changing how the benefit is provided, funded, and administered. This makes it very difficult for the DOL to provide a single answer or direction. It really is a case-specific situation.

Wrangle will continue to defer to the Plan Sponsor on if a Schedule A for stop loss is to be included and if the level-funding arrangement requires the 5500 is to be prepared as a trust.

If you have any questions on these topics, feel free to reach out to Ann McAdam at amcadam@wrangle5500.com.