You think that you’ve crossed the finish line with e-filing but how do you know for certain? What does Wrangle do to communicate? How do you access the e-filed reports? How long do you keep the 5500 and acknowledgment ID? Where can I find the SAR? How does the Dashboard re-set? All these questions and more are answered below.

Wrangle’s E-filing Process and Crossing the Finish Line

After the client signs with DocuSign, signed pages sit temporarily in the Dashboard. If you click the “E-filing” box on the Scorecard, the status will be noted that the filing is waiting to be e-filed.

Wrangle will typically upload the forms to the e-filing interface and submit the filing to the DOL within 1 business day of receiving them.

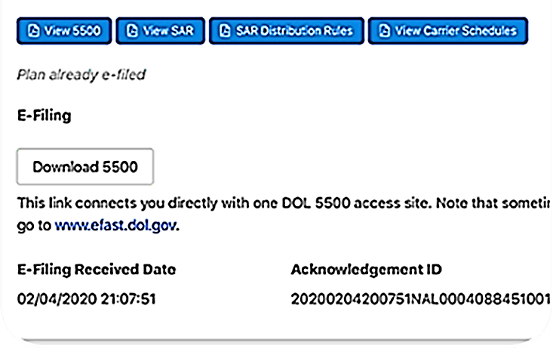

When we e-file the DOL’s EFAST2 system will generate an acknowledgment ID code. This 30-digit number signals a successful e-filed Form 5500. We house this data in the Dashboard for you as well as send you an informative email with the needed details to be kept with the Plan Sponsor’s files.

How Do I Access the Form 5500

On the Dashboard, click the “Download 5500” button found above the Acknowledgement ID to have direct access to the e-filed Form 5500. You can also go to the DOL’s EFAST website to download.

You may also click on the link in the email we send you – that will take you straight to the 5500 on the DOL’s EFAST Website.

Side note: The EFAST2 website publicly shows successfully submitted Form 5500s (forms and attachments), with the following exceptions:

- filings/attachments containing sensitive information (e.g., Social Security number)

- filings for plan years before 2009

How Long Do I Keep the Acknowledgement ID Details and Signed Form 5500?

ERISA §107 requires six years after the 5500 has been e-filed; however, we encourage you to save documentation for eight years for an additional safety net.

How Do I Access the SAR?

The SAR was provided to the plan sponsor in their DocuSign envelope, and you can access it on our Dashboard.

How Do I Access a Copy of the Manually Signed 5500?

The Plan Sponsor was instructed in their DocuSign envelope to print and sign a copy of the 5500 for their records.

Do I Need to Reset the Dashboard to Prepare for the Following Year?

You do not need to do anything after the 5500 is e-filed. Our process carries forward to the new Plan year automatically (unless you instruct us otherwise). We will circle back with you two months after the end of the next Plan year to restart the process for your Form 5500 report.

For any additional questions, feel free to contact Ann McAdam at amcadam@wrangle5500.com