Many have their running shoes on to be ready on the starting line of renewal season. This blog gives you the “need to know” info to be able to quickly grab and run to your next task.

Another Extension Option:

With the IRS not issuing the special extension for calendar year plans to October 15th, we wanted to remind you of another extension, without using the Form 5558: the business automatic extension. As its name suggests, no forms need to be mailed for the Form 5500 to have the extension.

Instead, the automatic extension grants the Plan Sponsor an additional 1 ½ months, making the deadline through September 15th for a calendar year plan. Note: if the plan sponsor needs more time, the Form 5558 does provide 2 ½ months or until October 15th for calendar year plans.

The Form 5500’s automatic extension was rarely used in the past. However, with COVID-19, many businesses are needing more time to prepare their federal taxes and are filing extensions for those opening the door for the 5500 automatic extension.

Criteria to Meet: Per the Form 5500 Instructions:

An automatic extension for the Form 5500 would be until the due date of the federal income tax return of the employer. The following conditions are first required to be met:

- The plan year and the employer’s tax year are the same

- The employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the Form 5500

- A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records.

One catch – if you use the automatic extension, you void the chance to use Form 5558 for the regular extension.

Important Note: Wrangle will file the standard Form 5558 to give Plan Sponsors in our system until October 15th to e-file. This extension will be put in place starting on July 27th and will be automatically done, unless the broker or plan sponsor reaches out to Wrangle. The best approach is to contact your 5500 Consultant with the instructions. If you do not know who your 5500 Consultant is, feel free to ask Ann McAdam for assistance: amcadam@wrangle5500.com.

Preview of the 2020 Form 5500:

Wrangle was given a preview of what the Form 5500 will be like in 2020. Thankfully, there will be no major changes from 2019. The small exception is if you have a trust filing. There were minor modifications to the Schedule H. Wrangle’s blog in December will go into more detail.

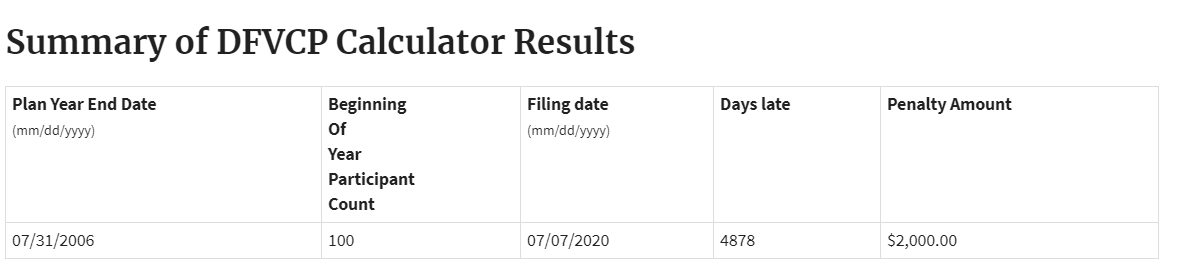

Change to the DFVC Penalty Payment Process

Currently, the Department of the Treasury is not offering the option at the end of the late filing penalty payment process to have an email receipt sent to the payee. There is a workaround for this item:

- On the bottom of the second page “DFVC E-Payment Data Collection”, below the Plan Sponsor, Administrator, and Contact information is a summary of the years and penalties for this particular payment. Wrangle recommends that the group prints this page for their records.

HEROES Act

The HEROEs Act looks like it will come to light when Congress is back in session on July 20th. This may bring more changes to the Plan Documents and SPDs. Wrangle is closely watching and will bring to your attention need-to-know information as soon as possible.

If you need further details on these topics feel free to reach out to Ann McAdam for assistance: amcadam@wrangle5500.com.