This blog post is the first of a three-part series to provide you with Wrangle’s checklists and guides for your Form 5500 reporting, Plan Documents, and SPDs and NDT Testing. These materials are purposely crafted to help you answer your questions and give you added comfort in entering data in our 5500 Dashboard and Plan Document Platform. Links to these documents will be provided.

This blog post is the first of a three-part series to provide you with Wrangle’s checklists and guides for your Form 5500 reporting, Plan Documents, and SPDs and NDT Testing. These materials are purposely crafted to help you answer your questions and give you added comfort in entering data in our 5500 Dashboard and Plan Document Platform. Links to these documents will be provided.

The Checklist and Guide Provided Are:

Checklist # 1 (found below):

- Wrangle Health and Welfare Form 5500 Checklist – Getting Started

Guide #2 (posted at the end of June):

- What is to be Reported in the Form 5500

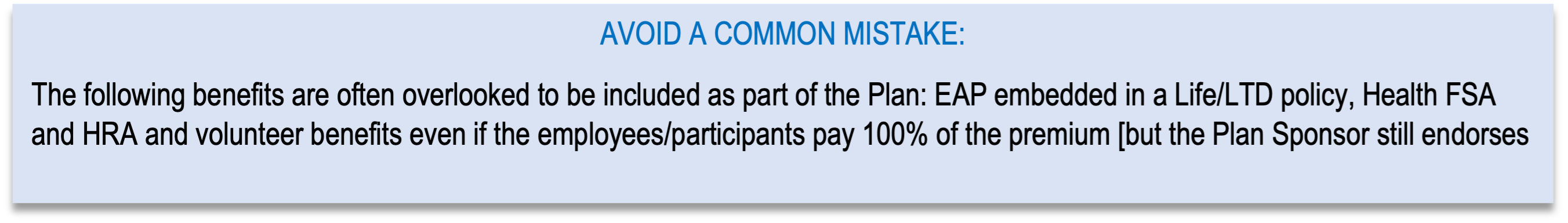

This provides information on what the Form 5500 entails and how reporting is handled for unique scenarios like reporting EAP when a carrier/vendor refuses to provide a Schedule A.

Guides #3 and #4: (will be posted in July):

- #3 Wrap Plan Document Intake Guide and

- #4 Informational Guide on the ERISA Desk Platform

For those who need instruction on the data fields in the platform and the step-by-step process to take to create a Plan Document or NDT Project.

Wrangle’s Health and Welfare Form 5500 Checklist – Getting Started

Your client needs to have a 5500 filed and you were told that you must go to the Dashboard to insert data. Great! Another database and you are unsure what to expect. How hard will this be? If you are prepared with the following information, you will find that you will spend only approximately 15 minutes entering the data in the Dashboard. We promise this is easy.

For a PDF of the checklist click here.

Key Materials to Have On-Hand

Prior to completing the data points in Wrangle’s Dashboard, please have the following information readily available:

☐ ERISA Plan Document(s) or ERISA Wraparound Plan Document

☐ A copy of the last filed Health & Welfare Form 5500

☐ Client Benefit Summary or Enrollment Guide

☐ Wrangle’s Cheat sheets on how to use the Dashboard

To request any of these documents, email Ann McAdam at amcadam@wrangle5500.com.

Key Questions to Ask

Does the employer have 100 or more enrolled employees (EE) and ex-employees/COBRA on the first day of the ERISA Plan Year and is not a Plan under a Trust or a MEWA? If yes, a 5500 is required.

- If they have a Wrap Doc in place, check those benefits that are employer paid for the benefit most likely to hit this reporting threshold, e.g., life or EAP

- If they do not have a Wrap Doc in place, check every benefit/policy for the enrolled EE count

- Watch for MEWA or Trust filings – those are required to file regardless of their enrolled count

Has a 5500 been filed in the past?

- Check www.efast.dol.gov, and search by EIN

- If not, were they below the reporting threshold?

If a 5500 is needed, go to our website, wrangle5500.com, click on the 5500 Dashboard button in the upper righthand side, login and click on the Plan Sponsor Tab.

- Search Plan Sponsors by EIN or Plan Sponsor’s Legal Name. If the Plan Sponsor is already there, go to the Plan Sponsor record.

- If they are not there, click on Add Plan Sponsor. You will need:

- Plan Sponsor name

- EIN

- Address

- Plan name

- Plan number

- ERISA plan year

- Employer status: single, multiple, multi-employer, or DFE

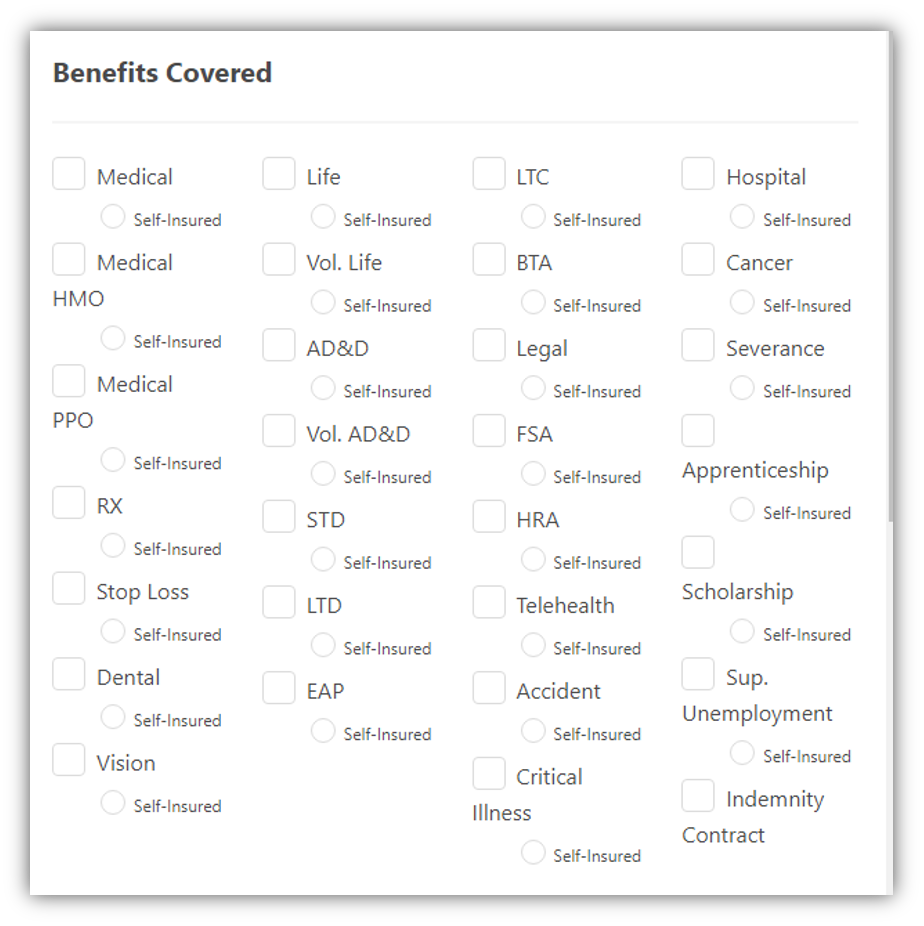

- Carrier names with benefits and funding (self or full insured). See page two for reference

- Once all is created, you will then go to the Plan Sponsor record and add in the policy details

- Carrier name

- Policy number

- Policy start and end dates

- Benefit(s) provided

- Check whether self-insured or fully insured

- Provide the carrier contact email address if you have a special carrier contact

- Provide other details

- Signer name and email address

- Counts for the Form 5500

- Other special notes:

- Example: Is this to be the final report, is there a collective bargaining agreement, etc.?

- Submit to Wrangle by clicking the green Submit Plan Button

Benefits to Consider