Oh no! I have a January 1 plan year client with a Form 5500 due date of 7/31/2024. I have not started working on their 5500. Is there still time to get this into the Dashboard? Will I have a Form 5500 report ready by the deadline? If not, can I have the Form 5558 extension? What immediate information is needed?

For the answers to these questions, read on, and as a bonus, there is new information to share on the Summary Annual Report (SAR).

Yes, you do have time to enter the details into the Dashboard. We will then be able to prepare the extension – Form 5558, with one exception:

New Plan Sponsors and Plan Details must be submitted no later than 12:00 PM PDT on the last day of the due date month to have an extension put in place.

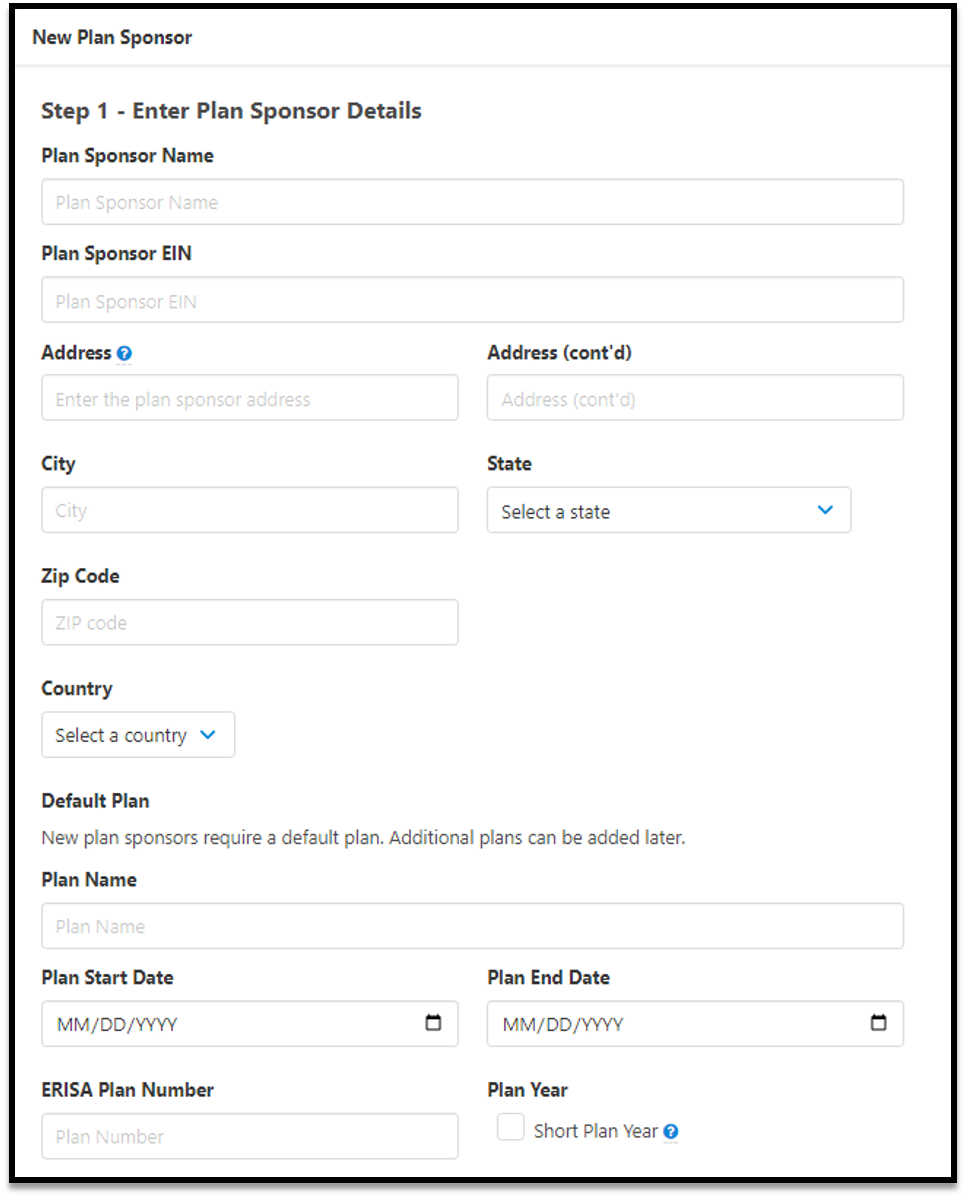

You will need to enter a new Plan Sponsor into the Dashboard and be sure to include the following information before you click the green submit plan button. Once the submit plan button is clicked, we will go into motion to prepare the extension.

Above is the exact set of details needed for the Form 5558, the form to request an extension.

We will have the Form 5558 with certified mail sent to the IRS if we have the information submitted in the Dashboard by 12:00 PM PDT on July 31st.

Form 5500:

More than likely, submitting information for a Form 5500 in mid-July with a 7/31 due date would not be enough time to complete the report for your client and e-file by July 31st. Please note: we do follow the first in, first out on the list of priorities for our Form 5500s.

Do not be concerned about using the extension. It is of value and a free gift from the DOL. It gives 2.5 months of additional time for the client to file an accurate and on-time Form 5500. We realize some brokers may see this as a negative, but it is certainly better than being late with a $10 penalty per day.

SAR:

Within the last few years, at the direction of the DOL, we have included the Paperwork Reduction Act’s two-paragraph statement in our Summary Annual Report. This was always perplexing to us as it never provided any benefit to the participants. However, the statement was in the SAR model notice located on the DOL’s website.

We spoke with the DOL’s Office of Regulations and Interpretations to see if these two paragraphs are still needed.

We were informed that the DOL requires that the statement appear in the SAR that is presented to the employer or Plan Sponsor. The statement does not need to be in the SAR that is distributed to the employees or participants.

In light of this information, we do need to continue to include the statement in the SAR that we present to the employer/Plan Sponsor. If they want to, they can remove it before sending it out to the employees/participants.

If you have any questions on any of the details in the blog, please contact Ann McAdam at amcadam@wrangle5500.com