MEWAs are shrouded in mystery for many due to the fact that since they are so complex and confusing, many simply avoid MEWAs altogether. The goal of this blog is to provide you with enough of the fundamentals to feel more acquainted with MEWAs. After all, if the Associated Health Plan proposal currently in review with the DOL is passed, the door will swing wide open for more MEWAs to form and arrange benefits for more small groups.

The Top 10 Attributes of MEWAs:

- The acronym, “MEWA” stands for Multiple Employer Welfare Arrangement.

- The DOL pays careful attention to MEWAs and would quickly audit if there were any reasons to inquire.

- In 1983, Congress added a special preemption rules to ERISA specifically authorizing limited state regulation of those MEWAs that also qualify as ERISA plans. States handle this provision differently though. For instance, many states do not allow new self-funded MEWAs so they are often limited to fully insured plan designs.

- They require two or more unrelated employers to enroll in the same benefit plan

- Visualize a conga line where people/the employers from different corners of the room come together to dance in line/to have the same benefit plan.

- A good example is a group of car dealerships within the same geographical area

- Many MEWAs form inadvertently especially during and after a merger/acquisition

- To be unrelated the group would not be under common control. To know if there is common control, Section 414 (c) of the IRS Code (See: 26 CFR §1.414(c)-2) is applied which is:

- “Common control” generally means,

- in the case of a parent-subsidiary group, the entities are connected through at least an 80 percent ownership interest or

- in the case of a brother-sister group: (a) five or fewer persons own at least an 80 percent interest in each entity, and (b) the same five or fewer persons together own a greater than 50 percent interest in each entity, taking into account the ownership of each person only to the extent such ownership is identical with respect to each organization.

- “Common control” generally means,

[Please note: Common control determination is particularly complex and tricky; additionally controlled group status of all entities allowed to participate in a plan is important, because this is the primary area where the MEWA forms inadvertently – common control levels were assumed to be in place when in truth they were not at the correct level. As a result, Wrangle strongly encourages for an ERISA attorney to be involved in the decision-making process.]

- A MEWA is always required to file a Form 5500 if the Form M1 has been filed; this is applicable even if the participant count on the first day of the ERISA Plan year is zero.

- The Form M1 is the annual registration of the MEWA with the DOL.

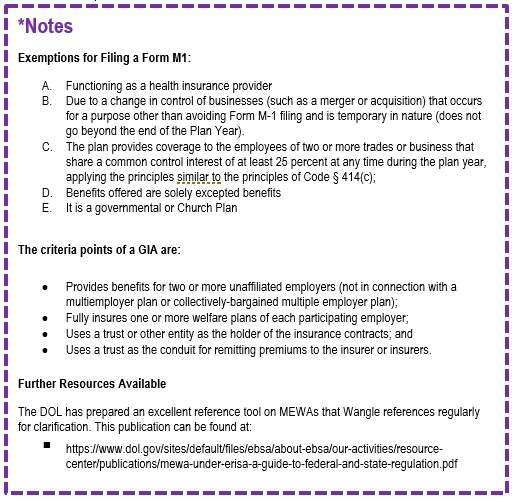

- Please note: Not all MEWAs need to file a Form M1 (and therefore would not need to file a Form 5500 if the group is under 100 enrolled participants and not under a Trust). See Notes* below

- The ERISA Plan is at the MEWA level and in this case the MEWA files the Form 5500. To be at the MEWA level, the MEWA is either a Group Insurance Arrangement (GIA)* or is an employer or an association of employers that meets:

- The commonality of interest tests: Example same line of business and in the same geographic location

- The Control tests: Requires the employer-members of the association to control and direct the activities and operations of the benefit plan

- f the ERISA Plan does not meet either of the above criteria tests, more than likely each participating employer would need to file a Form 5500 since the Plan is at the Participating Employer level (most ideal is to have an ERISA attorney review to help determine if the Plan is at the MEWA level or Participating Employer level).

- Starting with the 2014 Form 5500s, those that are under the Multiple Employer status are required to include an attachment with the following details:

- A list of the employers participating in the Plan during the Plan year and their EIN numbers

- A good faith estimate of each employer’s percentage of the total contributions (only if the ERISA Plan is also under a trust as found with a GIA).

- If MEWAs are not careful, the potential is greater of paying penalties than those who are not MEWAs due to all of the additional compliance requirements: Filing the Form 5500 correctly, Filing the Form M1 each year prior to March 1, issuing disclosure and plan material to all participants if the Plan is at the MEWA level, etc.

So the question that is pending – if you were the broker in the synopsis at the beginning of the Blog, would you be comfortable working with the prospect or decide to look elsewhere?