The cornerstone for an ERISA Plan is to have the required Plan Documents in place. Documents – plural? There is to be more than one? Many focus on the Wrap Plan Document, but more is needed for your foundation as we will outline in this blog.

At the end of this blog, we will update you on the possible mandatory Plan Amendments for 2025. The short answer is that there are none to report right now but there are some potential changes that we are monitoring as we wait and see how the benefit industry unfolds.

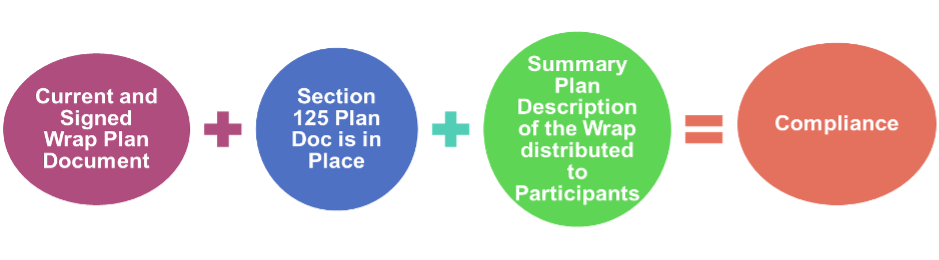

Plan Documents

The Wrap Plan Document outlines the benefit plan structure and the participants’ rights; it is required by ERISA. This document, in turn, is used to map out Form 5500, hence why Wrangle checks on it as we process the H&W 5500.

If the group uses pre-tax dollars to fund employee benefit contributions through a Premium-Only Plan (POP), this arrangement cannot be covered by the Wrap Plan Document. POPs are governed by IRS regulations and are not subject to ERISA oversight.

The IRS requires the POP Plan to have its own document, and it is labeled as the Section 125 or Cafeteria Plan Document.

If the group has a healthcare and/or dependent care flexible spending account, the FSA Plan document will incorporate the Cafeteria Plan Document material.

Can the Wrap Plan Document and Cafeteria Plan Document be combined?

The ERISA attorneys at Ascensus believe they should be maintained separately, especially since POP plans are not subject to ERISA. In addition, our ERISA Desk team has pointed out that the ERISA and IRS definitions of eligible plan participants are different as cafeteria plans have stricter rules on dependents and owners vs. employees.

Per the ERISA Desk Team:

“Our documents do include some information about the pre-tax contributions and mid-year election changes because those elements affect the benefits and rights of participants, but that’s not enough to be meet the cafeteria plan document requirements under Code Section 125.”

Where to find Cafeteria Plan Documents?

Wrangle now offers the ability to prepare the Section 125 / Cafeteria Plan Document through our Platform. You can enter this site from our homepage and once in the platform select Cafeteria Plan Document from the projects tab.

Are there any mandatory legislative amendments to come in 2025?

Currently, there are no mandatory changes that require amendments. As for the CHIPRA notice, the DOL’s EBSA unit reported no changes with the updated notice with the new effective date of 3/17/2025. We are also monitoring any developments for the HIPAA Notice and reproductive rights. As soon as we have any updates, we will inform you through our Blog Newsletter and/or an email blast. We are also monitoring any developments for the HIPAA notice and reproductive rights. As soon as we have any updates, we will inform you through our newsletter and/or an email blast.

If you have any technical questions on Plan Documents, please contact the ERISA Desk Team at ERISADeskInfo@ascensus.com. If you are interested in obtaining our services such as having a Cafeteria Plan Document, contact Elaine Harvey our Director of Sales at eharvey@wrangle5500.com.