In May, the EBSA, the “police” for the Department of Labor, released their findings on their audit enforcement program of employer-sponsored health and welfare plans. We summarized the findings for you and highlighted the key points that could impact you and your clients below.

In May, the EBSA, the “police” for the Department of Labor, released their findings on their audit enforcement program of employer-sponsored health and welfare plans. We summarized the findings for you and highlighted the key points that could impact you and your clients below.

Who is to be Audited?

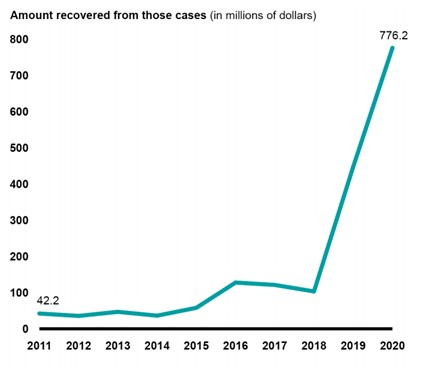

EBSA disclosed that they target their audits on those who will make the greatest impact, that is recovery of significant assets and/or that would affect many participants. They were not kidding. See the graph below for their success in collecting funds during an audit.

EBSA tends to target Multiple Employer Welfare Arrangements (MEWAs). However, groups not in a MEWA are not entirely safe. EBSA learns of potential audit contenders through referrals mostly, including participant complaints/inquiries. How many inquiries come to the DOL’s attention? See below.

In fiscal year 2020, benefits advisors responded to nearly 173,000 requests for assistance, 77 percent of which were from participants….Benefit Advisors referrals to EBSA (that led to an audit), represent 1/3 of all investigations.

In addition, EBSA’s operating plan guidance notes that criteria for deciding which investigations to pursue should reflect a balance of plan sizes and types.

EBSA staff decide whether to pursue an investigation based on the merits of the issue for investigation, including the egregiousness of the allegation, whether a correction has already been made, whether there are viable parties to pursue for corrective action, and whether the plan is a repeat offender.

Best practice: Keep the participants/employees well-informed of their benefits and address their concerns. Furthermore, if you know of an error or aspect of falling out of compliance, voluntarily correct as soon as possible using amended filings or the DFVC Program.

Why Plan Sponsors of Self-funded Medical Plans Need to be Careful:

EBSA further stated that the agency planned to focus on health plans’ compliance with requirements for reimbursement rates for the treatment of mental health conditions or substance abuse disorders (mental health parity), autism treatment limitations, denials of claims for emergency services, and fees paid to insurance companies and other service providers, among other things.

For health plans, the list of red flags includes improper cost-sharing for, or denial of, health care claims with the potential to affect a significant number of participants. Benefits advisors may refer such cases to EBSA.

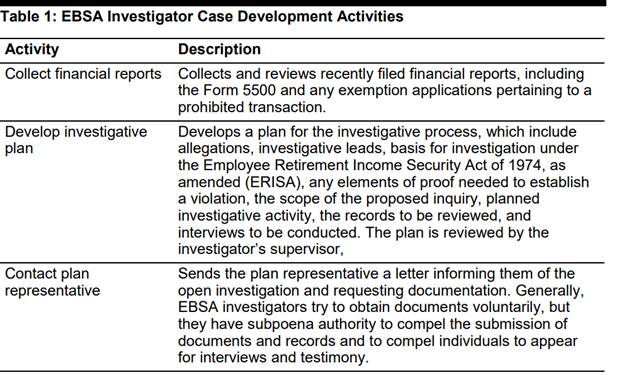

What Initial Documents Does EBSA Use to Determine to Audit?

They collect and review financial reports, such as the most recently filed Form 5500 report to start the process. See table below.

Top Ten Violations Found

The violations no doubt highlight the fact that a fiduciary’s job should not be taken lightly. How the role is carried out can make all the difference.

Please note: A fiduciary is not just tied to a trust. Per ERISA, a Plan Sponsor that exercises its authority over the Plan administration is deemed the fiduciary of the Plan.

| Violations | Wrangle Notes | |

| 1 | Plan fiduciaries shall discharge their duties solely in the interest of plan participants and beneficiaries and with the care, skill, prudence, and diligence. | |

| 2 | Plan fiduciaries shall discharge their duties solely in the interest of the plan participants and beneficiaries, and for the exclusive purpose of providing benefits to participants and their beneficiaries and defraying reasonable expenses of plan administration. | |

| 3 | Plan fiduciaries shall not deal with the assets of the plan in their own interest or for their own account, among other things. | |

| 4 | Plan fiduciaries shall not cause the plan to engage in a transaction if that transaction constitutes, among other things, a direct or indirect transfer to, or use by or for the benefit of, a party in interest, of any assets of the plan. | |

| 5 | Plan fiduciaries shall discharge their duties with respect to a plan, solely in the interest of participants and beneficiaries and in accordance with the documents and instruments governing the plan. | |

| 6 | The assets of a plan shall not inure to the benefit of (i.e., improperly benefit) an employer, but shall be held for the exclusive purpose of providing benefits to the participants and beneficiaries of the plan. | |

| 7 | Plan information shall be provided periodically and written in a manner reasonably calculated to be understood by the average plan participant. | Plan Documents and SPDs for Plan Participants are essential. Contact Wrangle’s ERISA Desk for assistance. |

| 8 | Every plan fiduciary and every person who handles funds or property of a plan, shall be bonded unless otherwise exempt. | |

| 9 | The administrator of an employee benefit plan must file an annual report, which includes certain financial statements and an opinion from an independent qualified accountant. | For most if there are 100+enrolled on the first day of the Plan year, a Form 5500 is required. When in doubt contact your 5500 Consultant for assistance. |

| 10 | All assets of an employee benefit plan must be held in trust by one or more trustees, who are to be named in the plan or trust instrument or appointed by a person who is a named fiduciary. |

If you have any questions on this material feel free to contact Ann McAdam, Technical Consultant at amcadam@wrangle5500.com.