Companies in the technology industry such as Twitter and Meta (Facebook) have announced major layoffs and are offering severance packages. This raises the question for many – are severance benefits under ERISA reporting and therefore do they potentially have a Form 5500 requirement? The answer all depends on how the severance is handled. This blog piece will help point out what a health and welfare severance plan is under the ERISA, and if it needs Plan Documents and Form 5500s.

There are key criteria points to have in place for a health and welfare severance ERISA Plan [as under ERISA § 3(1)]

- There is not to be a one-time severance payment or lump sum

- They are funded via the Plan Sponsor’s general assets or trust; they are not a payroll practice

- The benefit is not set in the collective-bargaining process

- There is an ongoing administrative scheme/responsibility to determine and communicate clear eligibility standards/rules and the calculation of benefits that are in turn shared with plan participants (via the SPD).

Please note: severance benefits can trip into a pension plan if the following takes place [as outlined under DOL Reg. §2510.3-2(b)]:

- Payments are contingent upon the employee’s retirement

- The total amount of such payments exceeds twice the employee’s annual compensation

- Payments extend beyond 24 months after the termination of the employee’s service (or in the case of a limited program of terminations, within 24 months of the employee’s normal retirement age, if later).

Plan Document and 5500 Requirements

As with a welfare Plan under the ERISA, a Plan Document is required to be in place and the SPD is to be issued to Plan Participants. If the reporting threshold* has been met on the first day of the ERISA Plan Year, the Form 5500 is to be filed. For the Form 5500, the participant counts follow a different pattern than a medical or life plan. For the active employee, you would count those who are eligible or entitled to enroll in the severance rather than just those who are enrolled in the severance. For example, ABC Company has 150 employees and all 150 are eligible. 12 former employees received the severance. For the count to determine if the 5500 is required, the 150-employee number is used, and the Form 5500 is required to be filed.

* The reporting threshold is: If the sum of enrolled active employees, COBRA subscribers, and Retirees (if applicable) exceeds 100 persons on the first day of the ERISA Plan year, the 5500 is required. Please note a trust filing or MEWA that file the Form M1 must file regardless of the participant count.

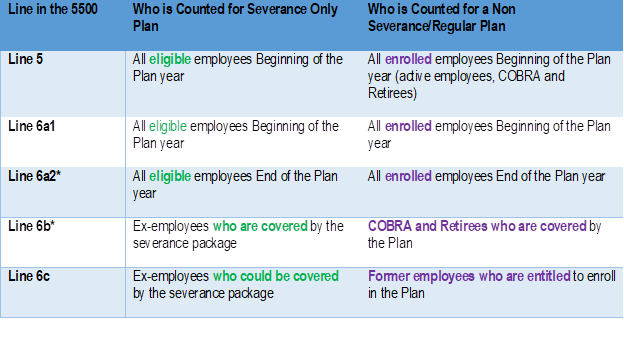

Participant Counts for the Form 5500 for Severance Plans Only

Below is a table highlighting how the counts are to be determined between a Severance-Only Plan and Non-Severance Plan. Reminder a Non-Severance Plan is one that is for benefits that are in active mode right away such as medical, dental, vision, etc. It is a benefit that meets the criteria listed in the Form 5500 instructions:

“…The date on which the individual becomes eligible under the plan for a benefit subject only to the occurrence of the contingency for which the benefit is provided.”

(Page 18 of the DOL Form 5500 Instructions)

(NOTE: For Non-Severance benefits, the number of enrolled employees is to be considered.

* 6a2 and 6b for Severance-Only Plans will be different data sets. 6a2 will focus on those eligible at the end of the year who are active employees. 6b are former employees who are now receiving the severance benefit. They don’t need to be on COBRA.

If there is uncertainty about severance benefits forming a welfare ERISA Plan, the best practice is to receive advice from an ERISA attorney.

If you have any questions or need additional information, please contact Ann McAdam, project manager at amcadam@wrangle5500.com.