When self-insured short-term disability (STD) is listed to be included in the Form 5500, we often do a double take. This benefit, under this funding arrangement, is more than likely exempt from ERISA, as it is labeled as a “payroll practice.” As a result, this benefit would not be reported in the Form 5500. This blog takes a deeper look at the arrangement to help clarify when the benefit should be under ERISA.

Under the Department of Labor’s Code of Federal Regulations (CFRs), the following guidance is noted for a payroll practice:

A payroll practice is exempt from ERISA when it constitutes a “payment of an employee’s normal compensation, out of the employer’s general assets, on account of periods of time during which the employee is physically or mentally unable to perform his or her duties or is otherwise absent for medical reasons (such as pregnancy, a physical examination or psychiatric treatment).” 29 CFR § 2510.3-1(b)(2).

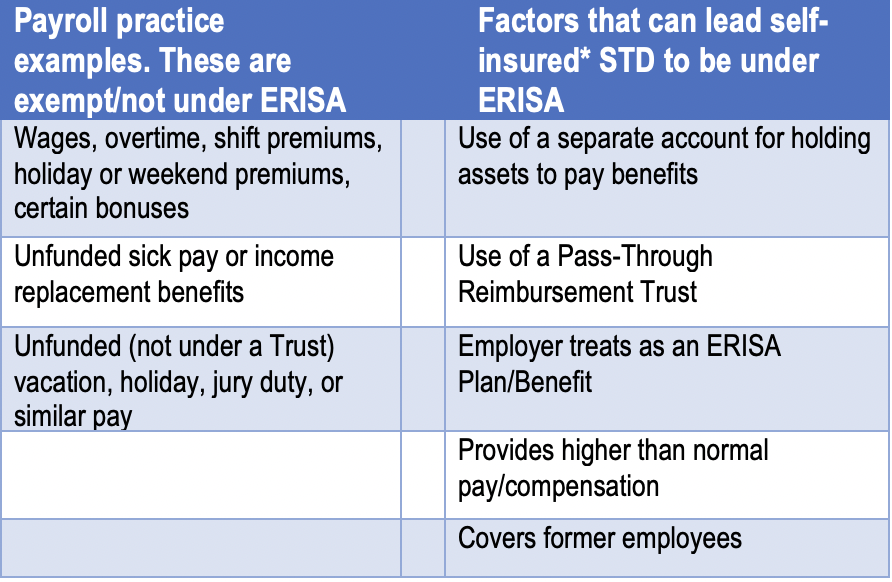

To help clarify the regulation, the table below shows a comparison of what is deemed a payroll practice and what is done to position a self-insured STD to be under ERISA rather than a payroll practice.

Please note: ERISA is a very complex area. No single chart can address all angles. We always recommend consulting with an ERISA attorney who will review your specific situation. This is not intended to be legal advice.

However, there are some game-changers:

- Funding a benefit through a trust removes the exemption and can create an ERISA Plan

- Note: If the employer pays first with general assets and then has a trust plan reimbursement (known as a Pass-Through Reimbursement) this would not create an exemption. This was upheld with the Ninth Circuit court Alaska Airlines Inc. v. State Bureau of Labor in 1997.

- If the benefit is listed in the SPD, Form 5500 report, etc., some courts have noted that this removes the safe harbor clause and could require the benefit to be under ERISA

- Payment of the Self-insured STD is more than normal compensation

- Payment to former employees

Overall, deviating from the above DOL’s 29 CFR § 2510.3-1(b)(2) can change the status of meeting the self-insured STD benefit as a payroll practice and needs to be handled carefully. When there is any uncertainty, we always encourage for an ERISA attorney to review and advise.

If you have any questions or need to discuss, please contact Ann McAdam at amcadam@wrangle5500.com.