Calendar Year Plans that had a change to the Benefit Plan within 2023 require the summary material modification (SMM) document to be distributed to Plan participants attached to the SPD by July 28th.

This may raise some questions:

- Why July 28th?

- If the Wrap Plan Document has a shelf life of five years, is this still required?

- What does an SMM look like?

These questions and others are answered below.

An ERISA Plan typically evolves after its inception date. A Plan Sponsor may decide to change the carriers for the benefits, enhance eligibility rules, add participating employers, etc. In addition, various governmental acts, such as ACA, the Secure Act, or the mandates of ERISA also could impose changes on a Plan. Regardless of the source, if the Plan experiences a change and is to be amended, the participants are to receive communication of this change. The document that they are to receive is called the Summary Materials Modification, the SMM.

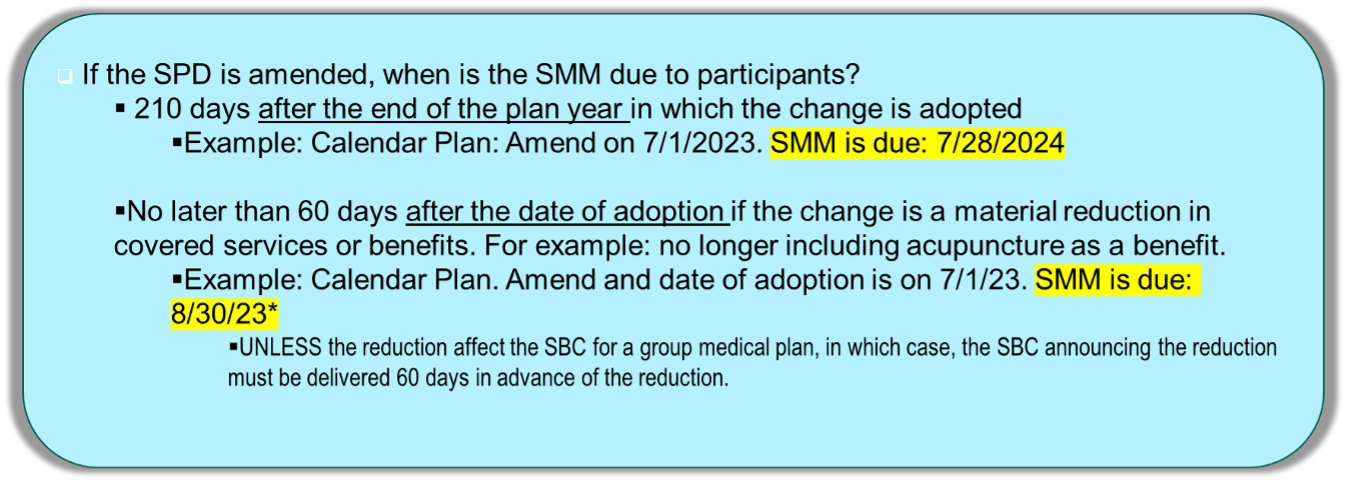

ERISA requires the SMM to be distributed within 210 days after the end of a calendar year. If the change is a deduction, the distribution timeframe is 60 days after the date of adoption. As mentioned above, if the change was imposed in 2023 for a calendar year plan, 210 days at the end of the calendar Plan year is: 12/31/23+210 days = 7/28/24

If the shelf life of a Plan Document and SPD is within five years is the SMM needed?

Yes, the SMM would be attached to the SPD. At the five-year mark, the SPD would be restated and amended incorporating the changes into the SPD.

What are Plan Sponsor-level changes typically found on an SMM?

Eligibility rules, adding or subtracting a benefit from the benefit plan structure, carrier, and address changes.

A benefit attribute change, such as the copay, would not be reflected in an SMM.

What does an SMM look like?

An SMM is typically titled, “Amendment to the Plan (name)”. The effective date of the change is followed by an opening paragraph that declares the changes of the Plan, followed by an outline of the change(s). A representative signature and date acknowledging the adoption of the amendment is also provided.

How should the SMM be distributed?

Distribute the SMM in the same manner as the SAR for the Form 5500 and the SPD: in person, via US mail, or electronically. Click here for a blog on distributions especially if you are interested in electronic distribution.

For more questions on this subject feel free to contact our ERISA Desk team at ERISADeskInfo@asceneus.com.

If you are interested in receiving more information on Wrangle’s ERISA Desk Platform that can track the 5-year shelf-life of the Plan Documents that we created, as well as the amendment reminders, reach out to Ann McAdam at amcadam@wrangle5500.com.