By Ann McAdam and Emily Marr

Wrangle’s goal is to help you gear up for your reporting and disclosure responsibilities in 2019. Thankfully, there are no new burdens detected. Never the less to saunter into 2019 without being mindful would not equate to a good start. Here are some key notes to stay abreast:

2018 Form 5500:

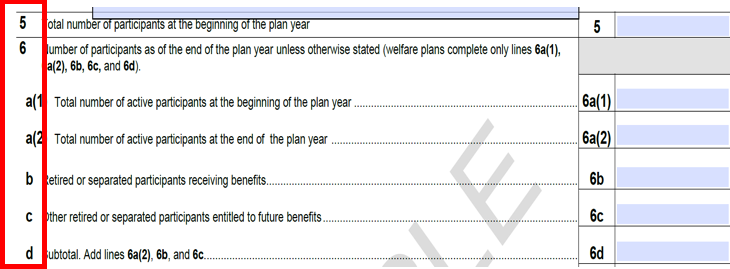

The DOL officially released copies of the 2018 Form 5500, its instructions as well as the various Schedules. As reported earlier this Fall, the 2018 Form 5500 is not to bring any wave of changes. The instructions did clarify elements of the participation counts. Mainly the following areas are to be completed for welfare plans*:

- #5, 6a1, 6a2, 6b, 6c and 6d

*Multiemployer plans are also to complete Item 7 which is to specify the total number of employers obligated to contribute to the plan.

One note: typically Wrangle does not see an amount for Health and Welfare Plans to be noted under 6c “other retired or separated participants entitled to future benefits.”

2018 Form 5558

The purpose of the IRS Form 5558 (Application for Extension of Time to File Certain Employee Plan Returns) is to request an extension for the:

- Form 5500,

- Form 8955-SSA (Annual Registration Statement Identifying Separate Participants with Deferred Vested Benefits), or

- Form 5330 (Return of Excise Taxes Related to Employee Benefit Plans).

The form itself has not experienced any changes. Never the less, the 2018 Instructions do emphasize that you cannot submit one Form 5558 to be the extension to request for the other forms attributed to it. What this exemplifies is that if you request Wrangle for the extension for your Health and Welfare Form 5500, you cannot then assume all is in place for an extension for your clients Form 5330.

Plan Documents and SPDs in 2019:

Unlike the 2018 plan year with the new disability claims provisions, there are no new federal regulations going into effect in 2019 that would require Wrangle to send out a legislative amendment and summary of material modifications (SMM) for wraparound plan documents and summary plan descriptions (SPD) prepared by Wrangle’s ERISA Desk plan document services in 2018 or earlier.

As the year comes to a close though…

The time is good to review your client’s or your plan documents to determine what changes, if any, have been adopted in 2018 that will modify the benefits, eligibility, or other plan design elements for the 2019 plan year.

If a plan modification changes the contents of your client’s or your plan document and SPD, an amendment and SMM should be prepared and executed, and the SMM should be distributed to plan participants.

Wrangle ERISA Desk provides some free amendment and SMM template services for plan documents prepared by ERISA Desk (i.e., for carrier changes, eligibility changes) or we can prepare final amendments and SMMs for our fee of $150. To find out more about these services, please contact Emily Marr in our ERISA Desk division at emarr@wrangle5500.com or 415-461-3912.

Non-Discrimination Testing:

Many brokers rely on the TPAs who administer the Section 125 and self-funded benefits/plans to notify when to run nondiscrimination testing. Be careful going into a new year without some of the basics for yourself:

When the various plans under Section125 and self-funded benefits are under a proved reliable plan design, testing results are often fitted with expected positive outcomes. The utilization tests typically found under the Section 125/POP and Dependent Care benefits encompass variance and therefore testing should not be treated as nonchalant.

Wrangle Standards for Testing (tests all conducted by Wrangle ERISA Desk):

Section 125/POP: 3 Tests:

- Eligibility Test,

- Contributions and Benefits Test, and

- Key Employee Concentration Test.

Section 129 Dependent Care FSA NDT Testing includes 4 tests:

- Eligibility Test,

- Contributions and Benefits Test,

- More-Than-5% Owners Concentration Test,

- 55% Average Benefits Test

Section 105(h) Health FSAs, HRAs, and self-funded health plans includes 2 tests:

- Eligibility Test and

- Benefits Test.

Even though regulations are to test at the end of the Plan year, best practice is for pre-testing completed at the beginning and/or middle of the plan for new plans or if problems passing the test are anticipated.

Common Surprises on Non-Discrimination testing:

– Section 125 – POP plans are to be tested.

– Section 129 – Dependent care is also to be tested and pay particular attention around utilization – the 55% Average Benefits Test. This tends to be an area of vulnerability to pass.

– Section 105h (Health FSA, HRA and other self-funded health plans) – The Code does not directly address when testing should be performed, but in order to retain favorable tax treatment, the plan must satisfy the tests “for a plan year,” suggesting that the plan must be monitored for issues at all times during the plan year.

For questions and concerns on non-discrimination testing, feel free to contact Emily Marr at emarr@wrangle5500.com.

2019 Form 5500s

The form year that was to bring a seismic shift to Form 5500s as we have known it seems to have evolved into a deflated balloon with no place to go other than being swept away to the corner. All speculation though on this front has been made by ERISA attorneys and other die-hard followers of the 5500s including yours truly. Since no one from the DOL has made any spectacular declaration, we will continue to monitor with curiosity to see if anything in the end does come what was noted back in 2017.