Gearing up for the biggest deadline for Form 5500s of the year, July 31st, Wrangle receives many questions on reporting, particularly those focusing on penalties. Many are dancing around the debates of should we or should we not file and those “What if…” scenarios are played out.

Gearing up for the biggest deadline for Form 5500s of the year, July 31st, Wrangle receives many questions on reporting, particularly those focusing on penalties. Many are dancing around the debates of should we or should we not file and those “What if…” scenarios are played out.

Here is a breakdown of those penalties asked by many for you all to see:

| Penalty Description | Penalty Amount |

| Failure or refusal to file Form 5500 (imposed by the Secretary of Labor) | $2,194 per day *

|

| Late Filer (imposed by the EBSA of the DOL) | $50 per day from the day the filing was due until the day filed without regard to extensions.** |

| Non Filer (imposed by the EBSA of the DOL) | $300 per day up to a maximum of $30,000 per year for each year the plan has not filed an annual report. The penalties are cumulative but in most cases are capped at $180,000. ** |

| Significant reporting errors such as financial reporting items (e.g., errors on Schedule H, missing Schedule of Assets) | $100/day capped at $36,500 ** |

| Non-critical missing or deficient reporting items | $10/day capped at $3,650 ** |

| Not including the IQPA Report/Audit for a Form 5500 under a Trust Plan | $150 per day capped at $50,000 ** |

| Failure of MEWA to file required report (M-1) | $1,597 per day *

|

| Failure to furnish employee benefit plan documents to the DOL (including plan and trust documents, SPD, SMM, collective bargaining agreement | $156 per day

(but no greater than $1,566 per request) * |

* Source

** Source

Generally speaking, the DOL’s offices will issue a formal letter outlining areas of omissions and other deficiencies with a file. This letter has a time-sensitive response requirement from the Plan Administrator. If the Plan Administrator does not comply in the time allotted, one can very much expect to see these penalties enforced.

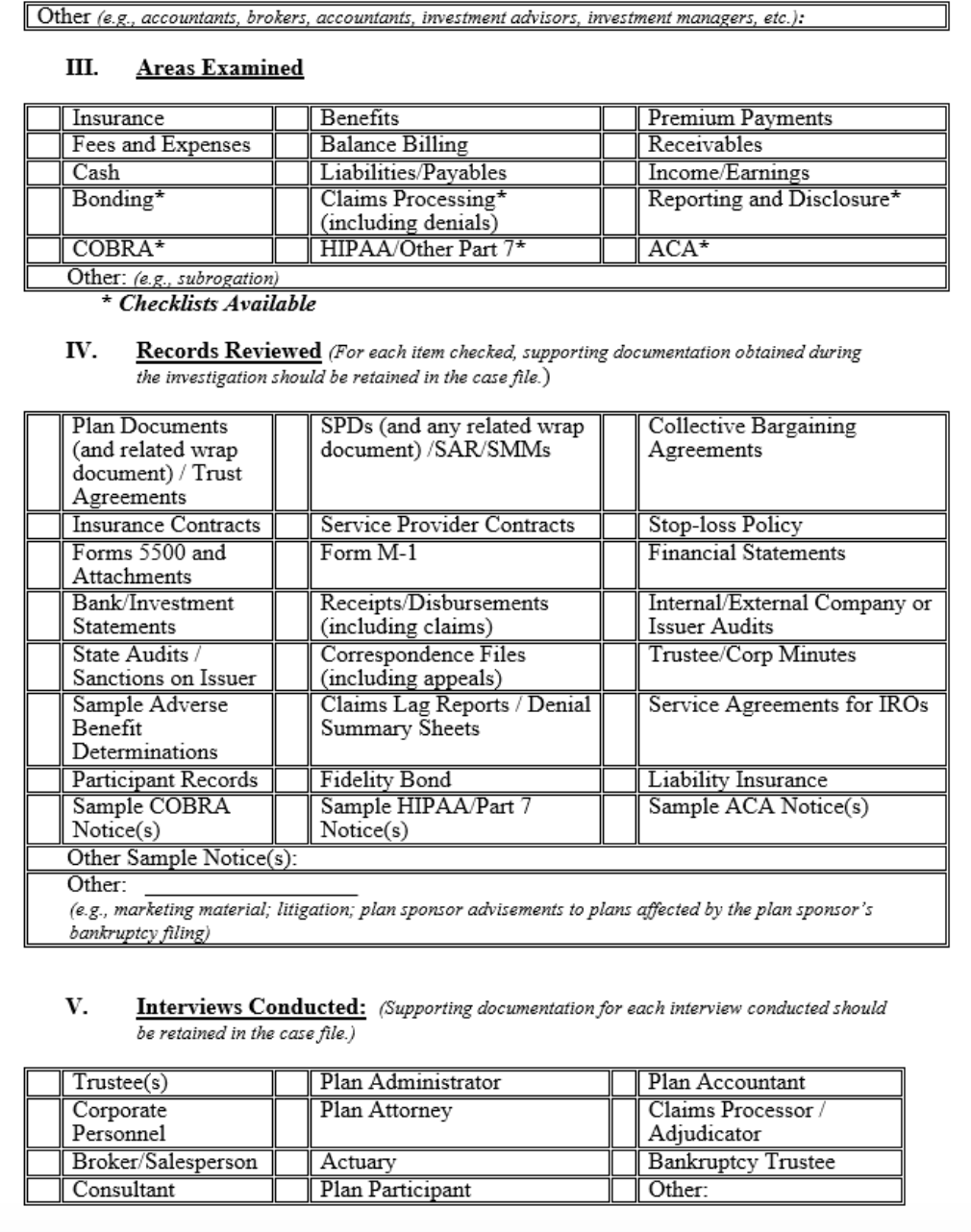

Audits:

Many also have asked Wrangle what is involved in an audit and what materials are requested. Here is the list taken from the DOL’s Enforcement Manual on what is generally required and who is interviewed. In case you wondered, broker’s and salespersons are on the list;

If you have questions on filing a Form 5500 and/or using the Delinquent Filer Voluntary Compliance Program (DFVC) to avoid some of these penalties surrounding the non-filer and late filer, please contact Ann McAdam at amcadam@wrangle5500.com.