We are thrilled to bring you the latest developments regarding the Plan Docs/NDT Platform (Platform). Additionally, we’re happy to share details about the frequently requested inquiries on Premium Only Plan (POP) documents.

Platform’s New Developments

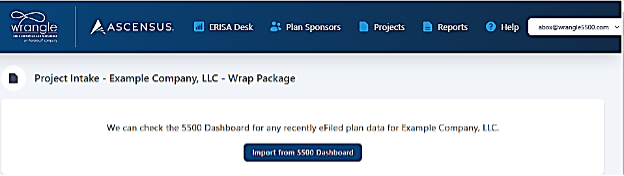

For those who have Form 5500 Report details housed in our 5500 Dashboard (Dashboard), entering data into the Platform just became much easier. Why? Auto population is in place.

When you start a new Wrap project for an existing Plan Sponsor on the Platform or want to add a new Plan Sponsor to the Platform that already exists in the Dashboard, you can cue the Platform to obtain the details to import from the Dashboard.

Also, the Help section will offer easily accessible, recorded, short snippets to watch and learn how to conduct the needed steps for the Platform. You no longer are restricted to watching a 30-minute pre-recorded webinar. Instead, you can go straight to the area where you need assistance.

Where to access the snippet videos:

Click on the 4th tab at the far right in the header at the top.

Gaining Access to the Platform

If you have a username/password to the Dashboard, the same is to be used for the Platform. If you need access to the Platform, contact Elaine Harvey (eharvey@wrangle5500.com) to set up a service agreement. Finally, if you have technical questions about the Platform, how to use it, etc., contact the ERISADESKInfo@ascensus.com.

POP Plan Documents

We regularly receive three key questions on Premium Only Plan (POP) Documents:

1. Are POP Plans under ERISA? Do they need an SPD?

No. They are not under ERISA but rather are under the IRS. They are not assigned a Plan number and do not require the SPD. POP Plan details (carriers and benefits) may also be listed in the Wrap Plan Document. Until a legally sufficient POP/Cafeteria Plan Document is in place and the employee is enrolled under its terms, premium conversion amounts may be taxable to the employee in the event of an IRS audit that uncovers that the documents were not in place. W2s would need to be updated.

For more information on POP Plan Details, read our past blog.

2. If a Wrap Plan Document is not in place, but the POP Plan Document is, can the POP Plan Document be used for the details of Form 5500?

No. The POP Document serves as the funding mechanism but is not a listing of the employee benefits structure as found in the Wrap Plan Document. This was highlighted in the DOL Advisory Letter, 1996-12A.

“The Pre-Tax Plan does not constitute, in itself, a separate employee welfare benefit plan within the meaning of section 3(1). It is, rather, part of the Group Health Plan in as much as it constitutes a mechanism by which the Group Health Plan, an ERISA welfare benefit plan (or plans), is funded with employee contributions.”

Without the Wrap Plan Document, benefits cannot be bundled and would be standalone benefits, each requiring their own Form 5500 if they met the reporting threshold of 100 or more enrolled participants on the first day of the Plan year.

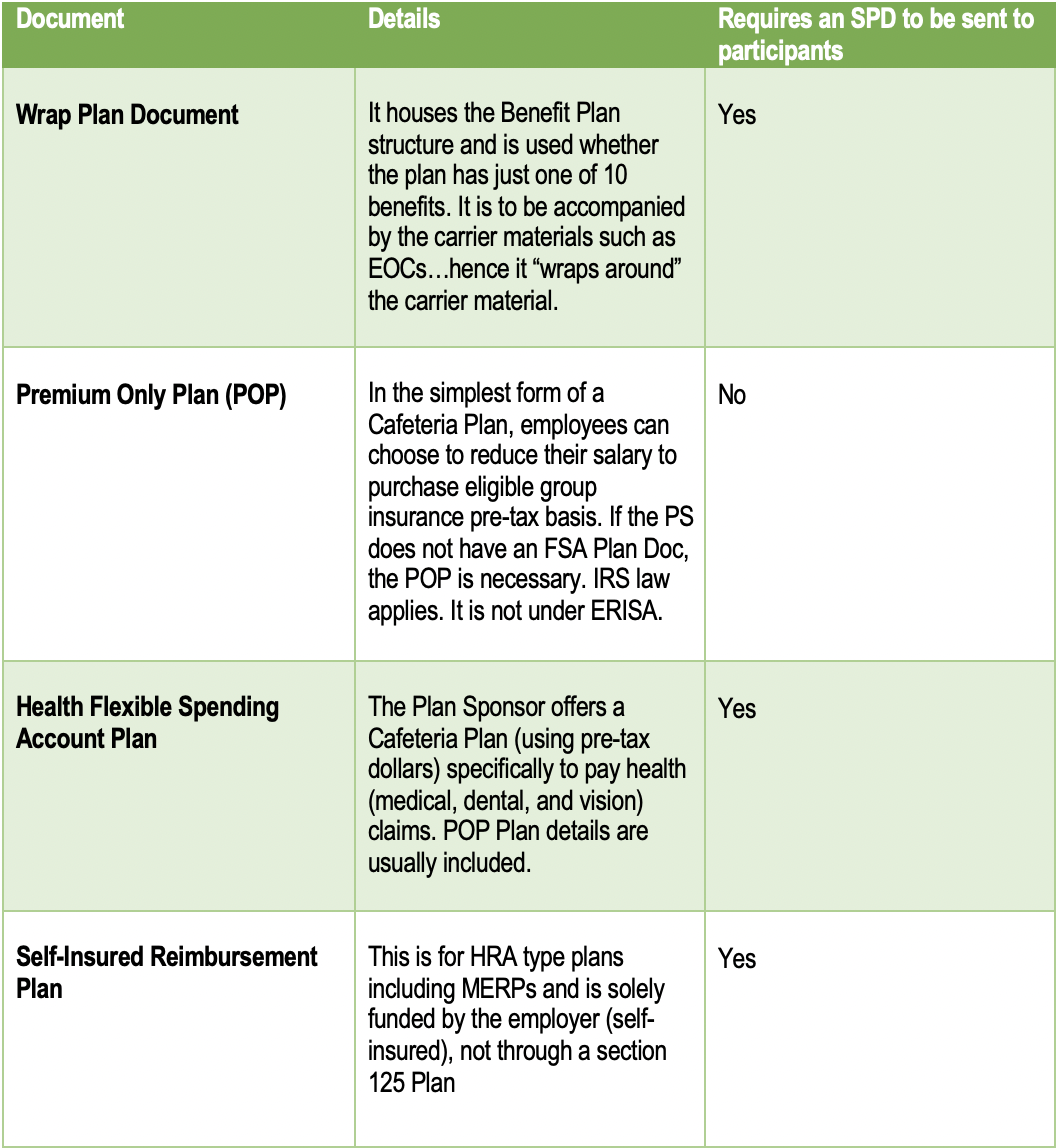

3. What are the Plan Documents available by Wrangle?

For any questions about using our Plan Documents services, contact Elaine Harvey, our Sales Director, at eharvey@wrangle5500.com.