Looking at the Big Picture for Reporting and Disclosure

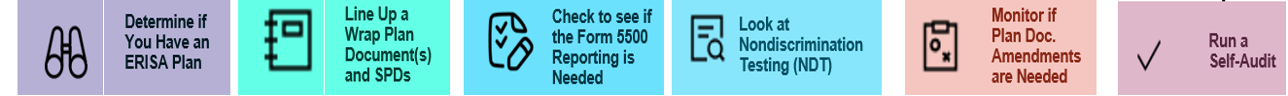

There are so many avenues to cover for a broker. ERISA, ACA, Secure Act, etc. We want to provide assistance here with some of the mandates under ERISA: Reporting and Disclosure. The following illustration encompasses the main compliance considerations for your client’s Health and Welfare Plan.

Each box represents an area that needs to be carefully considered with several aspects to check. For instance, under Determine if You Have an ERISA Plan, you need to check the following:

- Review each benefit to see if it is under ERISA or not.

- Have you considered wellness and EAPs in your lineup of benefits?

- Are there any voluntary benefits that need to be evaluated?

- Ask the question, “Does the Employer Endorse the Plan?” Hint: there is a five-point test to help answer.

- Review the funding and determine the benefit plan structure.

- Check to see who is sharing the benefits. Are there multiple employers? Is there common control?

In our upcoming webinar,

“Demystifying the Details Needed to Set Up a Wrap Plan Document, H&W Form 5500, and NDT,”

we will go over each of these four points as well as those found under the five boxes above. Our goal is to help you establish a solid foundation and then in turn educate your client in this crazy and complicated ERISA world where we all reside.

To register for this upcoming one-hour webinar on February 29th, Click here. All those who register will receive a copy of the slides and the link for the recording.

Feel free to reach out to Ann McAdam at amcadam@wrangle5500.com with any questions.