For many who have the January 1 Plan year, late June is when the Plan Administrator is being called for duty to sign the Form 5500s. Here are key reminders on signing. Please read below to learn when we will initiate the extensions:

1. The Department of Labor only requires the Plan Administrator line to be signed on the Health and Welfare Form 5500s.

2. The Plan Sponsor or employer should have the original with the wet signature for their files even though there is an electronic copy on the DOL’s website [per DOL Reg. §2520.103-1(g)]. The report would be kept for a minimum of 6 years from the date of filing per ERISA. (Wrangle advises you to retain that copy for 7 or 8 years in case of an audit.

Note that a signed copy of the 5500 must be available upon a participant’s request at no charge.

3. Details on who the signer or “Plan Administrator” is:

-

- Plan Administrator does not mean a person performing daily administration functions or a TPA.

- The person signing should be an officer of the company or have legal authority over the plan.

- The signer should consider having fiduciary liability insurance in place.

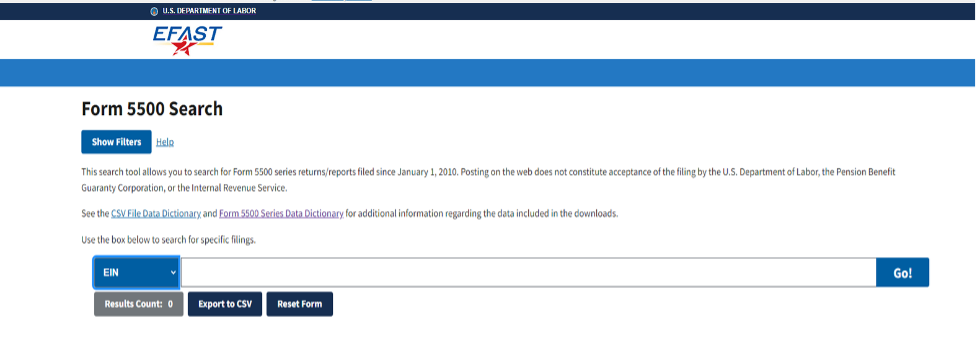

4. Once the signature is in place, the report must be e-filed. You can find it on the DOL’s EFAST2 website (available to all). The easiest approach is to look it up by the Plan Sponsor’s EIN.

DOL’s EFAST SITE: https://www.efast.dol.gov/5500Search/

Extensions:

If the 5500 is not e-filed a week before the due date, Wrangle will move forward and put an extension in place, provided all required plan details are in our Dashboard no later than noon PST on July 31st. This will give the Plan Sponsor until October 15th to e-file in a timely manner.

If you have any questions or need additional information, contact Ann McAdam at amcadam@wrangle5500.com.