Wrangle will soon have an available portfolio on the Health and Welfare Form 5500. It promises to provide the answers on what the needed information is for the 5500 and how to relay the data within it. Additionally, it will highlight exceptional situations that take extra consideration and how to handle them. Below is a portion of the portfolio to give you a preview at what to expect.

Wrangle will soon have an available portfolio on the Health and Welfare Form 5500. It promises to provide the answers on what the needed information is for the 5500 and how to relay the data within it. Additionally, it will highlight exceptional situations that take extra consideration and how to handle them. Below is a portion of the portfolio to give you a preview at what to expect.

What is the Health and Welfare (H&W) Form 5500?

The ERISA-mandated H&W Form 5500 Annual Report is a collection of data from an employee benefit plan. It primarily reports the number of enrolled participants, and the financials for the benefits and commissions of the brokers. It is not a tax report.

The Internal Revenue Service (IRS) and Department of Labor (DOL) review the data to ensure the operations of the Plan are in check. They also review key parameters such as participant levels, benefits offered, premiums paid, and funding to compile reports for Congress under ACA.

Penalties if the 5500 is Not Filed

The Employee Benefits Security Administration (EBSA) may assess the following civil penalties:

- For Non-Filers: A penalty of $300 per day, up to $30,000 per year, until a complete Form 5500 is filed

- For Late-Filers: A penalty of $50 per day, for each day an annual report is filed after the date on which the annual report was required to be filed, without regard to any extensions of time for filing

- Under extreme circumstances, the Secretary of Labor may fine up to $2,586 per day for failure to file

Penalties if the DOL DFVC Program is Used:

| Small Group | Large Group |

| Up to 199 days late: $10 per day | Up to 199 days late: $10 per day |

| From 200 days to 1 year late– capped at $750 | From 200 days to 1 year late– capped at $2,000 |

| Multiple years late – capped at $1,500 | Multiple years late – capped at $4,000 |

Who Files and When?

Required: Private corporations and nonprofits offering ERISA-level employee benefits to 100 or more enrolled active employees, COBRA subscribers, or retiree subscribers on the first day of the Plan year are required to file. Also, plans that hold plan assets in a Trust or a Multiple Employer Welfare Arrangement (MEWA) that files the Form M1 are to file regardless of the participant count.

Exempt: Governmental, Church Plans, and other Plans with under 100 enrolled participants that are not under a Trust or MEWA are exempt.

Due Dates: The Form 5500 is due seven months after the end of the Plan Year. If the Plan year is 1/1-12/31 the report is due July 31st. There is a one-time extension through the Form 5558 that provides an additional 2 ½ months if the 5558 is filed by the original due date. Other extensions may be granted through a presidential declared natural disaster or an extension of the employer’s federal income tax return.

What is the Difference Between a Plan Sponsor and the Plan Administrator?

Who can be the Plan Administrator?

The Plan Sponsor is the employer who maintains the plan. The Plan Administrator is typically an officer who is responsible for overseeing and administrating the legal aspects of the ERISA Plan and signs the Form 5500. They can be held personally liable (and even face jail time) for any wrongdoing. They should have fiduciary liability insurance.

What Helps Differentiate One Plan from the Other?

There are four critical identifiers that are determined by the Plan Sponsor and should be noted in the Wrap Plan Document*:

☐ EIN

- If more than one employer provides the benefits, the EIN found in the Plan Documents and the carrier contracts represent the Plan. If there is uncertainty about which is to be used, it is best to consult a legal advisor.

☐ Plan Name

- A standard Plan name is the Plan Sponsor Name + Brief Description of the benefit(s). Example: ABC Company Medical Plan.

☐ Plan Number

- For an H&W plan, plan numbers start at 501 through 998. 888 cannot be used as this is for Top Hat Plans. 001 – 499 are for retirement plans.

☐ Plan Year

- Section 3(39) of ERISA defines “plan year” as the calendar, policy, or fiscal year on which the records of the plan are kept.

These details are critical because the DOL uses them to track 5500s. If the wrong identifiers are used, a delinquent filing may be suspected by the DOL and penalties could come into play (see penalties on page one).

* If a Wrap Plan Document does not exist, the carrier contract may be used as the default. Please note that without a Wrap Plan Document, benefits from different policies or carriers cannot be bundled under the same ERISA Plan and Form 5500 report.

Can the Four Main Identifiers be Changed?

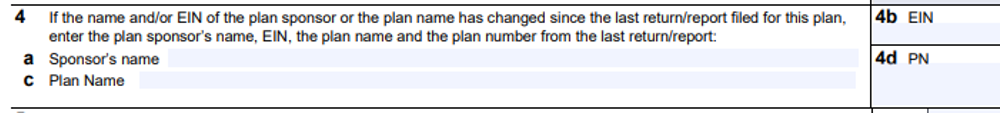

☐ Changing the Plan Sponsor Name, Plan Name, and EIN are permitted. This often happens during an acquisition or if the Plan Administrator updates the Wrap Plan Document. On page two of the 5500 under #4, the old identifiers should be listed. Page one lists the new identifiers.

☐ Changing the Plan Year is achieved by filing a short Plan Year** and then a full twelve-month Plan Year. Amending a Plan Year retroactively is discouraged as this will change the filing deadline, and the DOL may upon review require a late filing penalty.

☐ Changing the Plan Number can involve two options. The first one should be cleared by the DOL before proceeding.

- Amend and re-efile just the most recent Form 5500 filed (even if there are multiple years with the wrong Plan number), noting the correct Plan Number, and attach a letter from the Plan Sponsor providing more detail and an explanation on why the plan number changed. Presumably, that explanation would include that it was being amended to match the ERISA Wrap Plan Document. Wrangle will use item #4 on the 5500 to note the plan number that the 5500 was previously filed under.

- If the Plan Number from one year to the next changed due to an amendment to a Wrap Plan Document, then the year prior to the change needs to file a final Form 5500. Going forward, the 5500 needs to be a first-time filing under the new plan number. If the change took place and a final report box was not checked, Wrangle can amend the previous 5500 filing.

Example: If the Plan Number for 2019 was 504 and the Plan Number for 2020 is going to be 505, then they need to file a final for 2019 for Plan 504 and first for 2020 for Plan 505.

Overall, whether the situation is based on either option above, in coming to a decision on what Plan Number to use, especially if there are changes from one year to the next, the best practice is to review with an ERISA attorney and receive advice on the next steps.

Page 2 #4 of the Form 5500

For any questions on this material or if you would like a copy of the portfolio, please contact Ann McAdam, Project Manager, amcadam@wrangle5500.com.