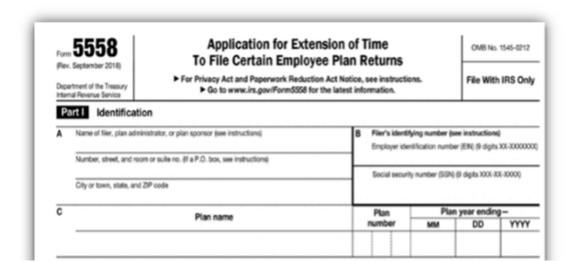

The Health and Welfare Form 5500 is due seven months after the end of the ERISA Plan year. Even with the best preparation tools in place, situations outside of a person’s control can mean more time is needed to have the Form 5500 ready for e-filing. Fortunately, by submitting the Form 5558, the DOL and IRS will grant an additional 2 ½ months more time to prepare and e-file on time.

The Health and Welfare Form 5500 is due seven months after the end of the ERISA Plan year. Even with the best preparation tools in place, situations outside of a person’s control can mean more time is needed to have the Form 5500 ready for e-filing. Fortunately, by submitting the Form 5558, the DOL and IRS will grant an additional 2 ½ months more time to prepare and e-file on time.

When Must the Form 5558 Be Submitted?

It must be submitted on or before the original deadline of the Form 5500.

How Do You Submit?

The Form 5558 is an IRS form and through 2024, it is to be mailed on or before the Form 5500 deadline. To have proof that the form was mailed on time, certified return receipt mail is the best practice. Wrangle keeps copies of the receipts and can provide them to the IRS if they mistakenly deny the extension.

Starting in 2025, this form is to be e-filed through the DOL’s EFAST system. It will not be available to be viewed. An acknowledgment code will be provided as proof of successful e-filing.

One important note: If there is a mistake and it is e-filed, another Form 5558 cannot be resubmitted. See the right-hand column for next steps to take if this was to happen.

If Wrangle Prepares the 5558 is a Copy Available?

Wrangle includes a copy of the Form 5558 within the Plan Book upon publishing.

Specific Fields Needing to Match 100% between the Form 5500 and 5558

- Plan Sponsor Name

- Plan Sponsor EIN

- Plan Name

- Plan Start Date & Plan End Date

- ERISA Plan Number

If the Plan Sponsor Name, EIN, or other key details are listed on the Form 5558 in error, the 5500 should be e-filed with the same details listed on the Form 5558. After e-filing the 5500 would be amended to correct. If the Plan Sponsor’s name and/or EIN need to be updated, Wrangle will list the old data on page two under number four. The new/correct name and/or EIN will be listed on page one of the Form 5500. [Wrangle will not charge a preparation fee for the amended filing if we prepared the original].

Wrangle’s Preparation fee for the Form 5558?

Wrangle will not charge any additional fees for preparing the Form 5558.

Reminder: There is no signature line for the Form 5558.

If you have any questions or need to discuss, please contact Ann McAdam at amcadam@wrangle5500.com.