Without fail, the two questions that we receive daily are:

- “What is the difference between the ERISA Plan Year and the Policy Period?”

- “Can the ERISA Plan year and the Policy Period be different dates from each other within the Form 5500?”

Both the ERISA Plan Year (EPY) and Policy period make a significant impact on the Form 5500. However, they do so in a different way.

What is the difference between the ERISA Plan Year and the Policy Period?

The EPY is determined by the Plan Sponsor once they have offered benefits and formed an ERISA Plan.

- Often, an ERISA Plan Year can be the same as the renewal period of their benefits but does not have to be.

- The EPY can be different and may not match the policy renewal dates. For instance, it can be on the calendar year or their business fiscal year, even if the renewals are on a different policy period.

The ERISA Plan Year is then officially declared in the Wrap Plan Document. Within the Form 5500, the EPY can be found at the top of each page in the report, including the Schedules.

The Policy Period is also known as the renewal period and is the policy’s timeframe listed in the contract. If there is no Wrap Plan Document, the carrier contract may serve as the ERISA Plan Document by default, and the policy period would, in turn, be the ERISA Plan Year.

The ERISA Plan Year impacts the Form 5500 in two ways:

- To determine if a Form 5500 is required, the number of participants enrolled on the first day of the ERISA Plan year is counted, and if there are 100 or more enrolled participants (including COBRA and retirees) in the Plan, a Form 5500 is required for that plan year. Note: if there is a trust or a MEWA that filed the Form M1, the participant count is not applicable; all trusts and MEWAs file a Form 5500 regardless of the count.

- The ERISA Plan year is used to determine the deadline for the Form 5500 if it is to be filed. That due date is 7 months after the end of the ERISA Plan year, unless an extension is put in place.

*If the ERISA Plan year is 1/1/24-12/31/24, the Form 5500 report is due July 31, 2025, seven months from December 31.

Can the ERISA Plan Year (EPY) and the Policy Period be different dates from each other in the Form 5500?

As mentioned earlier, the EPY and policy period can be different. For the Form 5500 Schedule A, extra care needs to be taken in listing the policy period in this situation: the policy ending date must fall within the ERISA Plan year to be reported in that Form 5500. As a result, the Schedule A policy period may begin before the first day of the ERISA Plan year reported on the Form 5500.

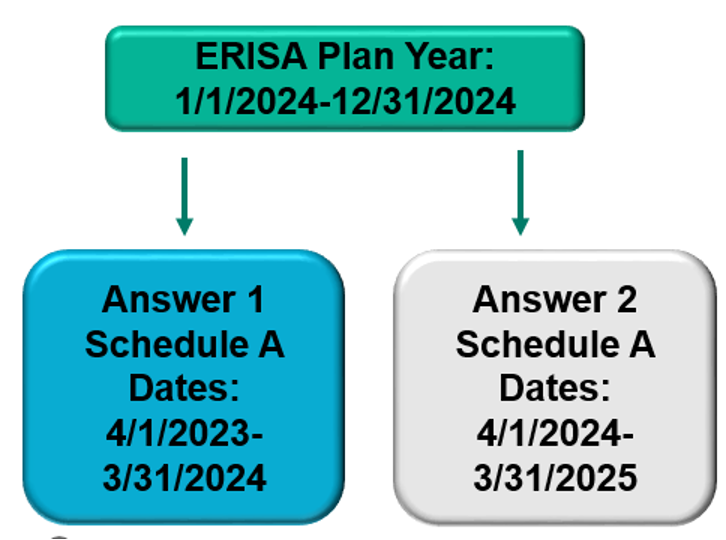

If you had a life policy that was a 4/1 policy period, and the Form 5500 was a calendar year, 1/1-12/31/24. What would you list on the Schedule A? Below are two choices. Which answer below is correct?

If you selected Answer A, you are correct.

Being Careful to Not to Line up a DFVC

As mentioned, when there is no Wrap Plan Document, the renewal /policy period is the ERISA Plan. When the Policy Period changes, as discussed between the DOL and Wrangle, the due dates for the Form 5500 are to change as well. Per the DOL if the new deadline is not met, they have a DFVC.

For an Example:

Group has no Wrap Plan Document. The Renewal/Policy period was with Anthem: 1/1/24-12/31/24 and the 5500 was due on 7/31/25. The group switched carriers midpoint: their Anthem policy termed and a new policy with Aetna changed to 5/1/24 to 4/30/25. They alerted us to the chance on March 15, 2025, when they loaded the data into the Dashboard. Their new line up is the following:

- Anthem 1/1/24-4/30/24 due 11/30/24; late by 121 days (from March 31, 2025) = $1,210

- New policy: 5/1/24-4/30/25 due 11/30/25

Be extra careful with mergers and acquisitions as this situation comes up when policies are termed or changed

In Summary:

Overall, knowing the policy periods when different from the ERISA Plan Year can be filled with uncertainty. Always ask Wrangle for assistance. We are happy to help.

For more information on the ERISA Plan Year and the Policy period, please contact Ann McAdam at amcadam@wrangle5500.com.