Brokers’ bread and butter are the commissions from insurance contracts. As to be expected, careful attention is placed on how the commissions are reported by the insurance carriers on the Schedule As. (Fully understanding also helps those stay competitive as they consider potential prospects for future business.) To help bring clarity and understanding, we’re providing key attributes of this financial aspect as found on the Schedule A. (Note: this blog does not go over commissions as listed in the Schedule C which should only be used in a 5500 where plan assets are held in trust.)

Overview

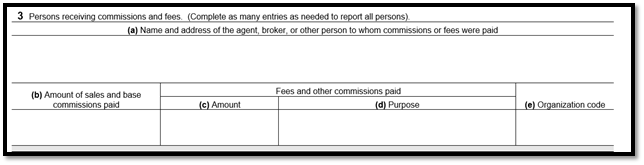

In a nutshell: Per the DOL guidance, all commissions (3b) and fees (3c), directly or indirectly attributable to a contract or policy between a plan and an insurance company or similar organization must be reported on a Schedule A.

Sales and base commissions are very straightforward; they are typically based, “in whole or in part, on the value (e.g., policy amounts, premiums) of contracts or policies” per the DOL. Fees on the other hand, tend to bring some need for clarification.

Fees

The various types of “fees” under 3c encompass many attributes. In 2005, the DOL came out with an Advisory Letter – 2005-02A to help clarify.

- Nonmonetary compensation (prizes, trips, gifts, memberships, vehicle leases, stock awards, etc.) if they are in whole or in part, on policies or contracts placed with or retained by ERISA plans.

- Fees and commissions paid from a separate bonus fund and not directly from an insurer’s general assets.

- Fees and commissions classified as profit-sharing, delayed compensation, or reimbursements for marketing or other expenses.

- Finder’s fees and similar payments made by third parties to brokers, agents, and others in connection with an insurance policy or contract, where the insurer reimburses the third party for such payments either separately or as part of the total fees paid by the insurer to the third party.

(Wrangle will include 1-3 words in the Purpose section “3d” to describe the nature of the fee.)

Reminder: ERISA takes the responsibility to report the commissions on the Carrier for a fully insured policy. Per the DOL:

For each contract for which a Schedule A must be filed, sections 103(a)(2), 103(c), and 103(e)(2) of ERISA and the Department’s regulations thus impose a legal duty on insurance companies and other organizations that provide benefits under an ERISA plan, or hold plan assets in a separate account, to furnish the plan administrator with accurate information about commissions and fees paid to brokers, agents, and other persons needed by the plan administrator to complete the Schedule A. Further, section 501 of ERISA makes it a criminal violation for any person to willfully violate any provision of Part 1 of Subtitle B of Title I, including section 103(a)(2), or any Department regulation issued under any such provision.(1)

If a Plan Sponsor disagrees with the amount reported by the carrier and changes that amount on the 5500 Schedule A, the ownership of and the liability for the data would shift to the Plan Sponsor. Therefore, we encourage to ask for a revised Schedule A from the carrier if the broker or Plan Sponsor disagrees with the data on the Schedule A.

How Does the Carrier Determine the Method for Calculating the Commission?

Carriers don’t need to follow strict parameters to calculate. However, once the approach is made, it must be consistent, and the method conveyed to the Plan Sponsor. Per the DOL:

Any reasonable method of allocating commissions and fees to policies or contracts is acceptable, provided the method is disclosed to the plan administrator.

What is the Organization Code?

Per the Form 5500 instructions, the organization code helps the DOL know the type of broker, agent or other person who receives the commissions. The most common for health and welfare 5500s is “3” Insurance Agent or Broker. Wrangle also recognizes that “5” may be used at times to indicate a third-party administrator.

How are Commissions Reported for a Self-Insured Policy?

If the policy is self-insured and not under a trust, commissions are not reported. If there is a trust, the commission may be listed in a Schedule C (this blog does not cover this type of benefit plan arrangement).

Are Fees for Service Paid by the Plan Sponsor Directly to the Broker to be Reported on a Schedule A?

Fee for services – if the arrangement between the broker and the Plan Sponsor is a fee for service arrangement where the Plan Sponsor pays the broker directly for their services, these fees are not reported on a 5500 Schedule, unless plan assets are held in trust, and the fee is paid out of trust fund asset.

For more information on this subject, contact Ann McAdam at amcadam@wrangle500.com.

- S. Department of Labor. (2005). Advisory Opinion 2005-02A. Retrieved from https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/advisory-opinions/2005-02a