In recent weeks, Wrangle has received scores of questions from brokers on COBRA counts for the 2020 Form 5500. This is a bit unprecedented; however, there is a good reason. It is all tied to the recent passing of the American Rescue Act.

In recent weeks, Wrangle has received scores of questions from brokers on COBRA counts for the 2020 Form 5500. This is a bit unprecedented; however, there is a good reason. It is all tied to the recent passing of the American Rescue Act.

Below, we have laid out the situation for you, with two options for reporting based on different interpretations. Please note, since the Form 5500 instructions do not provide clear guidance, we have contacted the DOL’s Office of Regulations and Interpretations for their feedback and are currently waiting for their response. As soon as we do have the DOL’s feedback, we will update this particular blog piece. One warning though: The Office of Regulations and Interpretations has not provided a definitive response date.

Situation:

The recent passing of the American Rescue Plan Act extended the time period for ex-employees to elect COBRA coverage. Those who have not elected COBRA as of 12/31/20 are now eligible again in 2021. In light of this, is the 2020 Form 5500 affected on the COBRA counts?

The Area in Question:

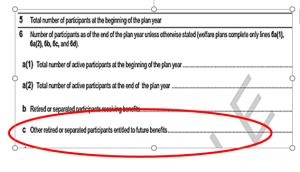

Line 6c on page 2: Other retired/separated entitled to future benefits.

Do those who have not completed an election form for COBRA still get to be listed under 6c? In other words, does simply being in the COBRA Election notice period allow them to be counted for 6c?

One Interpretation:

In this situation you may apply the following the ERISA Code of Federal Regulations (CFR):

- 29 CFR 2510.3-3(d)(2) states that an individual is not a participant covered under an employee welfare plan on the earliest date on which the individual (a) is ineligible to receive any benefit under the plan even if the contingency for which such benefit is provided should occur, and (b) is not designated by the plan as a participant.

The possible interpretation is that the receipt of the completed COBRA Election Form by the employer is the contingency, so employees in their COBRA Election notice period are not participants and would not be counted.

Please note, we would not be doing our job fairly if we did not also provide you a counterargument that you may prefer to apply.

Second Interpretation:

There is a great resource in the 5500 world, a book called, The 5500 Preparer Manual. The authors consider a different viewpoint. We have listed these details for you below. [Section in The 5500 Preparer Manual: Under Part 4 – Chapter 4 – Section 4.06- Line by Line Instruction Plan Participation (Lines 5, and 6a–6h)]

Per the 5500 Preparer Manual:

- This category includes retired or separated participants who are still covered by the plan and are entitled to begin receiving any benefits in the future. Include only those employees who are not included in line 6b.

- Example: Kyle Sanders terminated his employment but is eligible to enroll in medical and dental benefits, via COBRA, during the plan year. He declined this option but is still eligible to enroll for this coverage for part of the following plan year. He should be counted on Line 6c for the current plan year as entitled to future benefits.

Conclusion:

Ultimately, as your dedicated Form 5500 partner, Wrangle will defer to the decision of the Plan Sponsor and will prepare the Form 5500 with the information provided to us. If you have questions or need additional help and support, please do not hesitate to reach out to Ann McAdam, Wrangle’s Technical Consultant at amcadam@wrangle5500.com.

Reference Notes: 5500 Instructions:

All filers must complete both lines 5 and 6 unless the Form 5500 is filed for an IRA Plan described in Limited Pension Plan Reporting or for a DFE.

Note: Welfare plans complete only lines 5, 6a(1), 6a(2), 6b, 6c, and 6d. The description of ‘‘participant’’ in the instructions below is only for purposes of these lines. An individual becomes a participant covered under an employee welfare benefit plan on the earliest of:

- The date designated by the plan as the date on which the individual begins participation in the plan

- The date on which the individual becomes eligible under the plan for a benefit subject only to the occurrence of the contingency for which the benefit is provided; or -16- Instructions for Part I and Part II of Form 5500

- The date on which the individual makes a contribution to the plan, whether voluntary or mandatory. See 29 CFR 2510.3-3(d)(1). This includes former employees who are receiving group health continuation coverage benefits pursuant to Part 6 of ERISA and who are covered by the employee welfare benefit plan

An individual is not a participant covered under an employee welfare plan on the earliest date on which the individual (a) is ineligible to receive any benefit under the plan even if the contingency for which such benefit is provided should occur, and (b) is not designated by the plan as a participant. See 29 CFR 2510.3- 3(d)(2).