You may be wondering if you need to know anything after the February 2023 release of the DOLs and the IRS’s Phase III of the Form 5500 changes, and the answer is yes. However, as found with the first two sets of changes that were released in September 2021 and in May 2022, the imposed changes for the 2023 Form 5500 are mostly on pension. Nevertheless, there are three points to share that are worth knowing.

Shifts to the Form 5500

The way to obtain an extension for the Form 5500 is through the Form 5558 and in 2024, the Form 5558 will be allowed to be e-filed for the very first time. Why is this significant? E-filing quickly declares when a Form has been submitted. In trying to track the paper trail with the current Form 5558 approach, the IRS has unfortunately made many errors. More and more Plan Sponsors have received erroneous denial letters which brings unnecessary anxiety and concern. Once e-filing is in place in 2024, these mistakes should no longer come into play.

- Please note: Wrangle’s extension process is mostly behind the scenes when we process the Form 5558 since no signatures are required. You will not be impacted by the submission. You will just enjoy the disappearance of mistaken denial letters from the IRS.

Expansion of the Schedule H Section on Reporting Administrative Fees

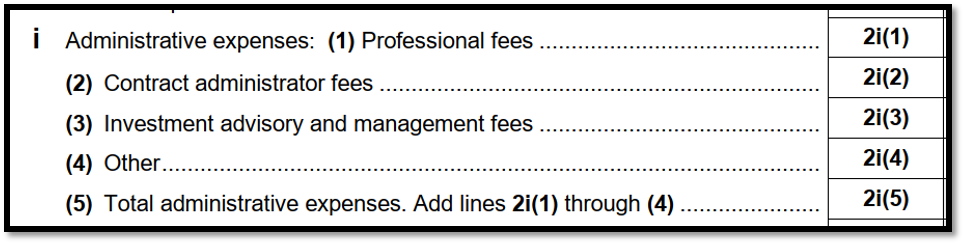

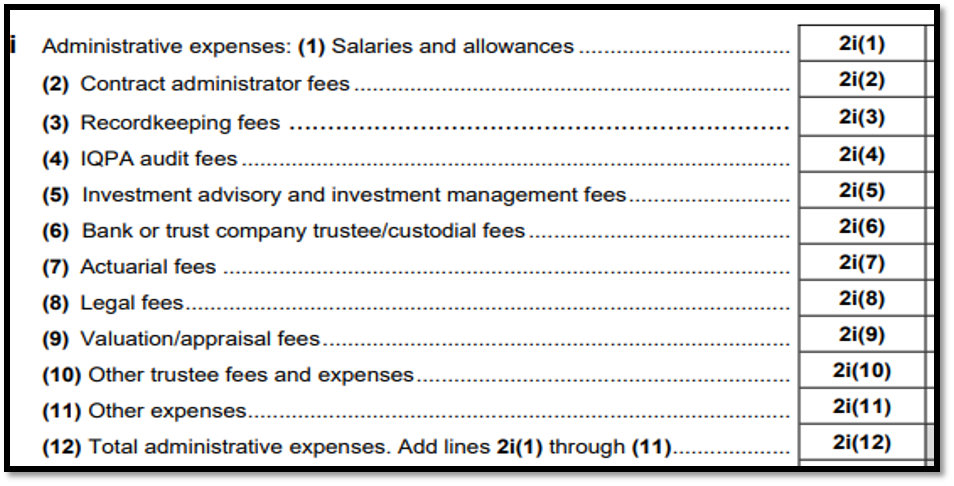

For those with a Trust Plan, the Schedule H’s section on reporting administrative fees has been expanded. The “Administrative Expenses” category of the Income and Expenses section of the Schedule H per the DOL, warrants to have more detail in this category for transparency. The data element breakouts for Administrative Expenses will now include twelve lines instead of five.

For Wrangle, this is good news. Too often the administrative fee is a “catch-all” category. We end up having to go back and forth with the auditor to help make sure the numbers are reported correctly. With the dollar amounts outlined in the audit, this should create a clearer picture and less confusion.

2022 / Current Schedule H’s Administrative Fees section:

2023 Schedule H’s Administrative Fees section:

DOL Considerations

Phase III did state that the DOL still plans to consider proposed changes that will impact health and welfare plans (see below). The review takes place likely this summer or fall, and we will continue to monitor. In June, we will meet with the DOL and EFAST2 team as an approved Form 5500 Software provider. We will explore these areas further at that time, and we will in turn keep you informed.

As noted in the September 2021 proposal, the DOL has a separate regulatory project on its semi-annual agenda to be in coordination with the IRS and PBGC:

- Modernize the financial and other annual reporting requirements on the Form 5500 Annual Return/Report.

- Continue an ongoing effort to make investment and other information on the Form 5500 Annual Return/Report more data mineable.

- Consider potential changes to group health plan annual reporting requirements, among other improvements that would enhance the agencies’ ability to collect employee benefit plan data in a way that best meets the needs of compliance projects, programs, and activities. See reginfo.gov for more information.

[Source: Click here to read the full write-up on these changes from the federal agencies.]

All in all, the 2023 changes will not significantly impact your clients’ health and welfare reporting. We will continue to monitor, and keep you updated on how the 5500 developments unfold. Be on the lookout for a blog covering our meeting with the DOL’s EFAST2 team this summer. For questions or comments feel free to reach out to Ann McAdam at amcadam@wrangle5500.com.