Many brokers have provided a similar sentiment to us: there is not a busy season, but rather the whole year is at a crazed and busy pace to handle all that is required.

To help you stay on track, here are key reminders under the ERISA Reporting and Disclosure for Q1:

Reminders

Plan Documents:

- For the new year, is there a change in benefits, carriers, eligibility rules, etc.? The Wrap Plan Document may be required to be amended.

- The Summary of Materials Modification (SMM) would be distributed within 210 days following the end of the Plan year unless it is a reduction. If benefits are reduced, the SMM is to be distributed 60 days from the date of the change. If this was for a January 1 Plan year date is February 28th.

- Reminder: the shelf life for a signed Plan Document and SPD is typically 5 years; at which time they would then need to be restated.

5500s

- Trust Plans require additional effort, particularly for large groups with over 100 enrolled participants. An IQPA report from an external CPA firm is necessary, so it’s best to begin promptly and plan for a 2 ½-month extension.

- For January 1 Calendar Plans, ensure data is entered and submitted in the Dashboard by the end of February.

- If you need 5500 counts for the PCORI Fee, please inform us as soon as possible. The 5500 must be e-filed by 7/31/25 to be used as a data source.

MEWA:

- File the Form M1 with the DOL by March 1

Entering into the Dashboard

For the January 1 Form 5500s, February is the time to enter the plan details into the 5500 Dashboard. Here is a checklist-like to help you review on your way:

Materials needed:

☐ ERISA Plan Document(s) or ERISA Wraparound Plan Document

☐ A copy of the last filed Health & Welfare Form 5500

☐ Client Benefit Summary or Enrollment Guide

☐ Wrangle’s Cheat sheets on how to use the Dashboard

- To request, send an email to Ann McAdam at amcadam@wrangle5500.com.

Areas to Consider

Does the employer have 100 or more enrolled employees (EE) + ex-employees/COBRA on the first day of the ERISA Plan Year and is not a Plan under a Trust or a MEWA? If yes, a 5500 is required.

- If a Wrap Document is in place, review employer-paid benefits, such as life insurance or EAP, to identify those most likely to meet the reporting threshold.

- If no Wrap Document is in place, review each benefit or policy to determine the enrolled employee count.

- Keep an eye on MEWA or Trust filings, as they must be filed regardless of enrollment count.

Has a 5500 been filed in the past?

- Check efast.dol.gov and search by EIN

- If no, were they below the reporting threshold?

If a 5500 is needed, go to www.dashboard.wrangle5500.com and click on the Plan Sponsor Tab.

- Search Plan Sponsors by EIN or Plan Sponsor’s Legal Name. If the Plan Sponsor is already there, go to the Plan Sponsor record.

- If they are not there, click on Add Plan Sponsor. You will need:

- Plan Sponsor name

- EIN

- Address

- Plan name

- Plan number

- ERISA Plan Year

- Employer status: single, multiple, multi-employer or DFE

- Carrier names with benefits and funding (self or fully insured).

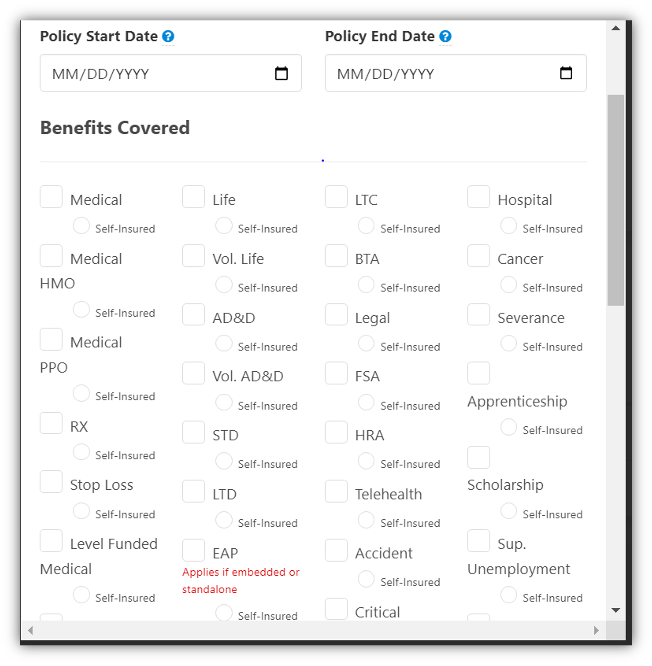

- Once all is created, you will then go to the Plan Sponsor record and add in the policy details:

- Carrier name

- Policy number

- Policy start and end dates

- Benefit(s) provided

- Check whether self-insured or fully insured

- Provide the carrier contact email address if you have a special carrier

- Provide other details:

- Signer name and email address

- Counts for the form 5500

- Other special notes:

- Example: Is this to be the final report, is there a collective bargaining agreement, etc.?

- Post to the plan sponsor at the same time

- Submit to Wrangle by clicking on the green Submit Plan button

Here is a screen shot taken directly from our Dashboard for you to preview and be aware of your options.

Avoid a Common Mistake:

The following benefits are often overlooked to be included as part of the Plan: EAP embedded in a Life/LTD policy, Health FSA and HRA, and volunteer benefits even if the employees/participants pay 100% of the premium [but the Plan Sponsor still endorses the benefit(s)].

If you have any questions or need further assistance, feel free to reach out to Ann McAdam for assistance.