Multiple times a day Wrangle faces a mystery: When we receive the worksheet data, the Plan Participant counts area is left blank. Of course, everyone knows the Form 5500 cannot be submitted in this manner. Wrangle pieces together what can be determined using existing data (read below for our standard defaults). Never the less, considering that the most accurate data comes from the client, we want to do all that we can to remove any sense of hesitancy or uncertainty on what is required for the participant counts.

Multiple times a day Wrangle faces a mystery: When we receive the worksheet data, the Plan Participant counts area is left blank. Of course, everyone knows the Form 5500 cannot be submitted in this manner. Wrangle pieces together what can be determined using existing data (read below for our standard defaults). Never the less, considering that the most accurate data comes from the client, we want to do all that we can to remove any sense of hesitancy or uncertainty on what is required for the participant counts.

For Health and Welfare benefit plans, there is generally-speaking only one key word to know when tabulating the participant counts: Enrolled. By being enrolled in the plan the person is a participant whether or not, they make a contribution.

True, there are those exceptions, where “eligible” to enroll participants are counted, because, those participants who actively use the benefit are not required to enroll. An example of this scenario is a severance plan or a stand-alone employee assistance program benefit.

Here is the Participant Count Breakdown as required on page two of the Form 5500 for the health and welfare plan:

- Line 5: Enrolled (active) Employees + enrolled COBRA/ex-employees + enrolled Retirees (if applicable) as of the first day of the ERISA Plan Year (EPY)

- For many, they choose to use the end count listed on the previous 5500 filing for this line. As an added note: there is no requirement from the DOL that this year’s beginning count matches last year’s ending count. In fact, more often than not it would be different as the enrollment changes between last year’s enrolled count and this year’s enrolled count.

- Line 6a1: Enrolled (active) Employees [excluding COBRA/ex-employees and Retirees] as of the first day of the EPY

- Line 6a2: Enrolled Employees (excluding COBRA/ex-employees and Retirees) as of the last day of the EPY

- Line 6b: Enrolled COBRA/ex-employees and Retirees as of the last day of the EPY

- Line 6c: Typically used for pension plans.

Wrangle’s Internal Standard Defaults

Reminder: the best source per the DOL is the client’s data; however we will use the following defaults if data is not provided to us)

Line by Line defaults if eWorksheet is left blank.

- Line 5

- Use last year’s ending count (previous year’s line 6d)

- If this is a first filing, use 100

- Line 6a1

- Use last year’s ending count (previous year’s line 6a2)

- If this is a first filing, use 100

- Line 6a2

- The highest enrolled employee only count from the available carrier schedules. The policy ending date should match the ending date of the ERISA Plan Year to be able to use the policy count as the default.

- The highest reported participant count divided by 2.35 (dependent to employee ratio; the 2.35 is the unit of measure applied in the PCORI fee calculations; the Form 5500 instructions do not provide any units of measure to apply).

- Line 6b

- Check all carrier schedules for any possible reported COBRA count

- If no count available, use zero

Many wonder why the Schedule As, particularly those for medical, dental and vision, can have a vastly different number of covered persons verses the number of participants on the Form 5500’s page two. The reason why is that the Schedule As for the health benefits typically include the dependents.

Per the DOL, the best source for the participant counts is in an enrollment census from the client or their TPA. There are those who do not keep accurate records leaving a broker feeling at an impasse as they stare at the eWorksheet. The search for a participant count can feel like a true hunt. Fortunately there are these tips to give the means to find the data. After all, as noted earlier, a Form 5500 report cannot have the participant area blank.

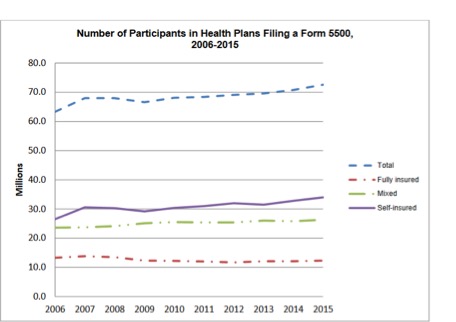

The Latest Data from the DOL:

Between the years 2006 and 2015, an average of 48,900 group health plans, covering an average of 68 million participants, filed a Form 5500 annually, [per the DOL’s 2018 Annual Self-Insured Health Plan Report to Congress, which analyzed the 2015 Data]

The DOL”s Semi-Annual Regulatory Agenda Has Been Released

FYI: The DOL released the semiannual regulatory 2018 Agenda which outlines the priorities for the next 12 months. The proposed changes to the 5500 for 2019 were not listed at all. What was?

Per the EBSA: “Regs will establish criteria for an employer group, or association, to act as an “employer” within the meaning of ERISA § 3(5), and sponsor an association health plan that is an employee welfare benefit plan, and a group health plan, under Title I of ERISA.”

Source: (Regulatory Agenda, www.reginfo.gov)

Did You Know…

There is a rule in the 5500 world which permits you to file a report based on the counts of previous filings to future filings. This is super helpful if you have a small group trust as a starting point which does not require the IQPA report. See below:

Name of Rule: 80-120 Participant Rule:

Description: If the number of participants reported on line 5 is between 80 and 120, and a Form 5500 annual return/report was filed for the prior plan year, you may elect to complete the return/report in the same category (‘‘large plan’’ or ‘‘small plan’’) as was filed for the prior return/report.

Perk: The 80-120 Participant rule can be applied for multiple years in a row, as long as the participant count does not increase to be 121.

For an example: in 2014 a Trust filing’s Participant Count at the end of the year was 84. (Trusts always have to file regardless of the participant count). A Schedule I was used and no auditor’s opinion (IQPA report). In 2015, the count increased to 110. However, since the group was 84 prior, they did not follow the large group requirements: IQPA report and the Schedule H.