Good News! The DOL captures the penalty amount due on the date that it is e-filed. If the payment is not submitted in a few days or even a week, this does not affect the penalty payment amount. The clock stops.

For example, if the 5500 report is due on May 31, 2025, and is e-filed on June 10, 2025—10 days late—the penalty amount is $100. If payment is then made on June 17, 2025, the DOL will still accept the $100 as payment in full, as the penalty is based on the e-filing date, not the payment date. At this time, the DOL has not informed Wrangle of any specific consequences for delayed payments. However, we continue to recommend that payment be made on the same day as the e-filing whenever possible to minimize any risk or confusion. We understand that this may not always be feasible due to scheduling conflicts, technical issues, or other unforeseen circumstances.

Here’s what’s changing:

| Item | Details |

| Forms of Payment | The DOL will no longer accept checks for payment beginning September 30th. Debit, credit card, or ACH are to be used going forward.

|

| Time of Payment | After the 5500 is e-filed, payment of the penalty needs to wait until the e-filed 5500 is listed on the DOL’s calculator page. This may take up to 24 hours. Previously, payment could be made on the same day. |

| Wrangle’s Process | Wrangle will need to e-file the DFVC files first, rather than wait until payment confirmation, as we did in the past.

As we always have been, we will be available to assist you with the payment system. |

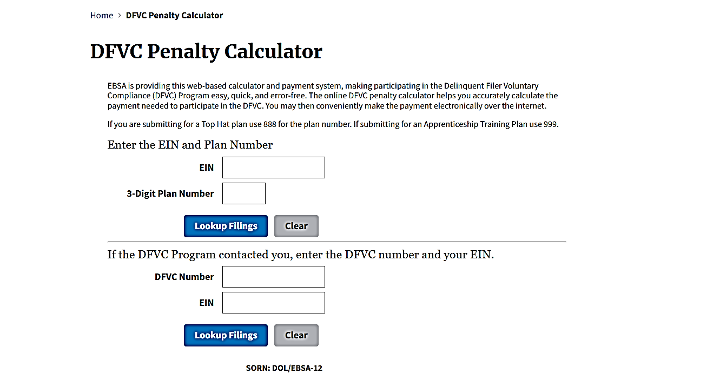

| Using the DOL’s Online calculator | You are required to insert the EIN and Plan number for the Plan Sponsor to start the process. Please note, this information is not captured by the DOL until the payment part of the process is in motion. Per the DOL rep, they do not save any information until the payment part of the process has been completed.

Unfortunately, the calculator can’t be used as a research tool to determine assess fees if the 5500 has not been e-filed yet. |

Here’s what’s not changing:

| Item | Details |

| Completing the Form 5500 as a DFVC | Remains the same. On page one of the 5500, the box for DFVC is to be checked. |

| Posting of the e-filed Form 5500 | Still within 24 hours after successful e-filing |

Website to use for DFVC Calculator and payment: https://www.askebsa.dol.gov/dfvcepay/#intake-form